Advertisement

Mortgage Rates Reverse Trend

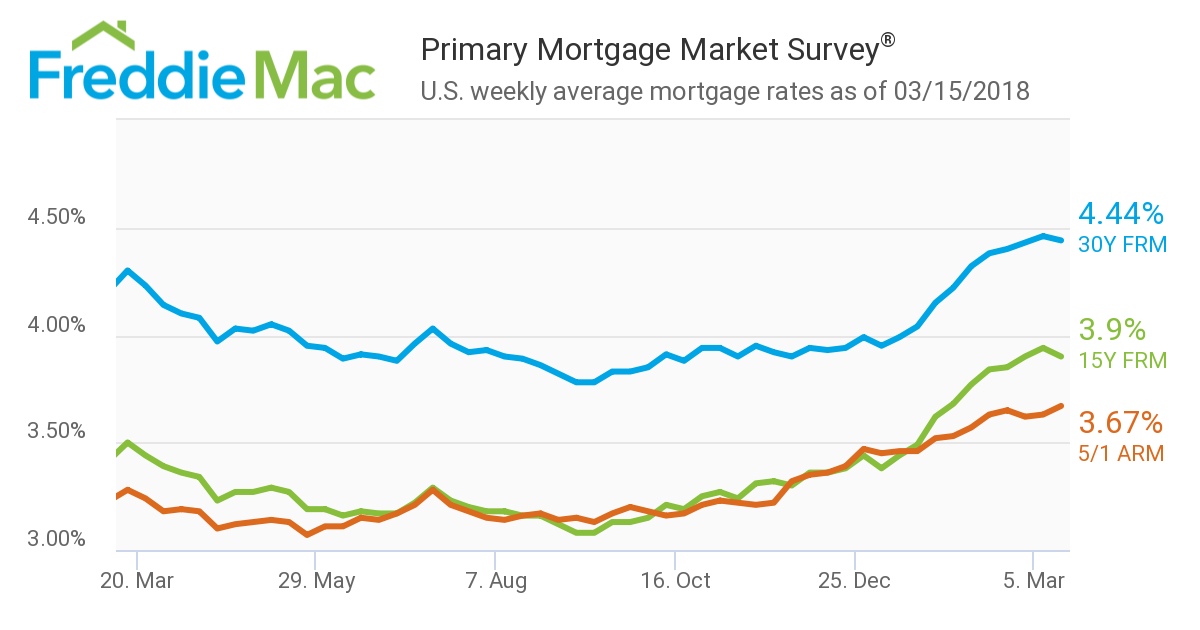

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing the 30-year fixed-rate mortgage (FRM) sliding after nine consecutive weeks of increases. This week, the 30-year FRM averaged 4.44 percent, with an average 0.5 point for the week ending March 15, 2018, down from last week when it averaged 4.46 percent. A year ago at this time, the 30-year FRM averaged 4.30 percent.

"Tuesday's Consumer Price Index report indicated inflation may be cooling down; headline consumer price inflation was 2.2 percent year-over-year in February,” said Len Kiefer, Deputy Chief Economist for Freddie Mac. “Following this news, the 10-year Treasury fell slightly. Mortgage rates followed Treasurys and ended a nine-week surge. The U.S. weekly average 30-year fixed mortgage rate fell two basis points to 4.44 percent in this week's survey, its first decline this year."

Also this week, the 15-year FRM averaged 3.90 percent with an average 0.5 point, down from last week when it averaged 3.94 percent. A year ago at this time, the 15-year FRM averaged 3.50 percent. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.67 percent this week with an average 0.4 point, up from last week when it averaged 3.63. A year ago at this time, the five-year ARM averaged 3.28 percent.

About the author