Mortgage Economic Review October 2021

The Mortgage Economic Review is a monthly summary of Key Economic Indicators, Data, and Events pertinent to Mortgage and Real Estate Professionals.

- Interest Rates: Rates jumped after the Fed announced they would soon begin tapering their Bond-Buying Program. The 10-Year US Treasury yield rose to 1.52% (9/30) from 1.31% (9/1).

- Housing: Home Prices continued their meteoric rise, up 19% in the past year.

- Labor: Disappointing Job creation, lower Unemployment, and good Wage growth. The Economy added only 235,000 new jobs, and the Unemployment Rate fell to 5.2%.

- Inflation: Inflation cooled a bit. CPI rose 0.3% (+5.3% YoY), PPI up 0.7% (+6.7% YoY).

BY MARK PAOLETTI | SPECIAL TO NATIONAL MORTGAGE PROFESSIONAL

The Mortgage Economic Review is a monthly summary of Key Economic Indicators, Data, and Events pertinent to Mortgage and Real Estate Professionals.

AT A GLANCE - Key Economic Data and Events during September 2021

- Interest Rates: Rates jumped after the Fed announced they would soon begin tapering their Bond-Buying Program. The 10-Year US Treasury yield rose to 1.52% (9/30) from 1.31% (9/1).

- Housing: Home Prices continued their meteoric rise, up 19% in the past year.

- Labor: Disappointing Job creation, lower Unemployment, and good Wage growth. The Economy added only 235,000 new jobs, and the Unemployment Rate fell to 5.2%.

- Inflation: Inflation cooled a bit. CPI rose 0.3% (+5.3% YoY), PPI up 0.7% (+6.7% YoY).

- The Economy: US GDP grew at 6.7% annualized rate during the 2nd Quarter of 2021.

- Consumers: Consumer Confidence declined while Consumer Spending rose. Real GDP Personal Consumption soared to a 12.0% annualized rate, and Retail Sales rose 0.7%.

- Stock Markets: The Markets had a choppy month and pulled back from the record highs set in August. The Markets closed September at: Dow 33,844, Nasdaq 14,449, S&P 4,308.

- Evergrande: The Largest Housing Developer in China missed several scheduled debt payments, which rattled the Global Financial Markets.

Interest Rates and Fed Watch

The last FOMC Meeting wrapped up on September 22. The Fed announced they would - sooner rather than later - begin "tapering" their Bond-Buying Program. However, they did not specify a start date. Fed Chairman Jerome Powell said: "Asset purchases still have a use, but it is time to taper them." When will the tapering start? That is unclear. Most Fed Watchers expect a start date to be announced after the November 3rd FOMC Meeting - provided the October Employment Data is favorable. When will it end? Powell said: "Completing taper sometime around the middle of next year will be appropriate." The Fed has been purchasing $120 Billion of MBS and Treasury Securities since March 2020 to support the Economy during the pandemic. The news sent Interest Rates higher and added volatility to the Stock Markets.

- 10 Year Treasury Security Yield: rose to 1.52% (Sep 30) from 1.31 (Sep 1).

- 30 Year Fixed Mortgage rose to 3.01% (Sep 30) from 2.87% (Aug 26).

- 15 Year Fixed Mortgage rose to 2.28% (Sep 30) from 2.17% (Aug 26).

- 5/1 ARM Mortgage rose to 2.48% (Sep 30) from 2.40% (Aug 26).

Housing Market Data Released in September 2021

Trees can't grow to the Moon. The meteoric rise in Home prices dominated the Housing News in September. All the Home Price Indexes show the same thing - Home Prices are up 20% in the last 12 months. Hot markets like Phoenix, San Diego, and Seattle are up a mind-boggling 32% - in a year. This is great if you are a Homeowner. It's depressing if you are a Homebuyer. Many Housing Economists feel Home Prices are reaching their peak. No one knows when the price escalation will stop. No one is expecting Home Prices to crash like in 2008. However, Homes are becoming unaffordable for many buyers - which will eventually limit further price increases.

- Existing Home Sales (closed deals in August) fell 2.0% to an annual rate of 5,880,000 homes, down 1.5% in the last 12 months. The median price for all types of homes is $356,700 - up 14.9% from a year ago. The median Single-Family Home price is $363,800 and $302,800 for a Condo. Homes were on the market for an average of 17 days, and 87% were on the market for less than a month. Currently, 1,290,000 homes are for sale, down 14.0% from 1,490,000 units a year ago.

- New Home Sales (signed contracts in August) rose 1.5% to a seasonally adjusted annual rate of 740,000 homes - down 24.3% YoY. The median New Home price rose to $390,900 from $390,500 the prior month. The average price fell to $443,200 from $446,000 the prior month. There are 378,000 New Homes for sale, which is a 6.1 month supply.

- Pending Home Sales Index (signed contracts in August) rose 8.1% to 119.5 from 110.7 the previous month, down 8.3% YoY.

- Building Permits (issued in August) rose 6.0% to a seasonally adjusted annual rate of 1,728,000 units - up 13.5% YoY. Single-Family Permits rose 0.6% to an annual pace of 1,054,000 homes, down 0.1% YoY.

- Housing Starts (excavation began in August) rose 3.9% to an annual adjusted rate of 1,615,000, up 17.4% YoY. Single-Family Starts fell 2.8% to 1,076,000 units, up 5.2% YoY.

- Housing Completions (completed in August) fell 4.5% to an annual adjusted rate of 1,330,000 units - up 9.4% YoY. Single-Family Completions rose 2.8% to 971,000 homes - up 8.5% YoY.

- S&P/Case-Shiller 20 City Home Price Index rose 1.5% in July, up 19.9% YoY.

- FHFA Home Price Index rose 1.4% in July, now up 19.2% YoY.

Labor Market Economic Data Released in September 2021

The Economy created 235,000 new jobs in August, disappointing Economists that expected 750,000 new jobs. Meanwhile, JOLTS (Job Openings & Labor Turnover Survey) posted another record of 10,900,000 jobs open in America. Are these data points paradoxical? If there are 11 million job openings, why did the Economy only fill 235,000? Some Economists blame the generous Unemployment Benefits (which ended Sep 4) for keeping workers from filling those positions. Next month we'll see if that theory has merit. Another theory is "skills mismatch". Many unemployed workers don't have the skills needed to qualify for the job. However, most employers are willing to do on-the-job training for unskilled job candidates.

- The Economy created 235,000 New Jobs during August.

- The Unemployment Rate fell to 5.2% in August from 5.4% in July.

- The Labor Force Participation Rate was unchanged at 61.7% in August.

- The Average Hourly Wage rose 0.6% in August, now up 4.3% YoY.

- Job Openings rose to 10,900,000 in July from 10,100,000 in June. \

Inflation Economic Data Released in September 2021

Inflation Data moderated with the CPI up 0.3% during August. The lower Inflation Data is welcome news and supports the Fed claim that the high level of Inflation is Transitory. A deeper dive into the data makes it clear that cars, shelter, and energy are driving Inflation. The shortage of cars is directly attributed to a semiconductor shortage. A shortage of homes for sale is more complicated and will take longer to normalize. These issues will be resolved sooner or later. What about Wages? Higher wages are a long-term driver of Inflation, but that can be neutralized by higher productivity. So at this point, mixed data is pointing to Inflation being temporary.

- CPI rose 0.3%, up 5.3% YoY | Core CPI rose 0.1%, up 4.0% YoY

- PPI rose 0.7 %, up 8.3% YoY | Core PPI rose 0.6%, up 6.7% YoY

- PCE rose 0.4%, up 4.3% YoY | Core PCE rose 0.3%, up 3.6% YoY

GDP Economic Data Released in September 2021

The 3rd Estimate of 2nd Quarter 2021 GDP showed the US Economy grew at a 6.7% annualized rate, up slightly from the 2nd estimate of 6.6%. The Economy continued to recover rapidly despite the headwinds created by the Delta Variant. Consumer and Business Spending remained strong, while Government Spending decreased slightly. Real Personal Consumption (Consumer Spending) was up a whopping 12.0% - the largest since 1952. Residential Fixed Investment (Home Sales) was down big - 11.7%. Inventories continued to decline (supply chain issues), while US Exports hit a record high.

- GDP Growth 2Q2021 (3rd estimate): 6.7% annualized rate

- US GDP Output: 2Q2021: $22.7T | 1Q2021: $22.0T | 4Q2020: $21.5T | 3Q2020: $21.1T

Consumer Economic Data Released in September 2021

Retails Sales jumped while Consumer Confidence continued to decline. The Consumer Confidence Index was down 3 months in a row during July, August, and September. Why? There seems to be an unending stream of bad news - Delta Variant, Afghanistan, Vaccine Mandates, Inflation, Home Prices, Gasoline Prices, Supply chain disruption, etc. All the bad news hasn't stopped the Consumer from spending money. Retail Sales jumped 0.7%, attributed to lingering pent-up demand and generous Unemployment Benefits (that ended Sep 4). Next month we'll see how Retail Sales holds up now that Federal Unemployment Benefits have ended.

- Retail Sales rose 0.7% in August, now up 15.1% in the last 12 months.

- Consumer Confidence Index fell to 109.3 from 113.8 the previous month.

- Consumer Sentiment Index (U of M ) rose to 71 from 70.3 the previous month.

Energy, International, and Things You May Have Missed

Oil Prices rose to over $80/barrel then fell back after oil stockpiles increased.

- West Texas Intermediate Crude rose to $75/barrel (Sep 30) from $69/barrel (Sep 1).

- North Sea Brent Crude rose to $79/barrel (Sep 30) from $71/barrel (Sep 1).

- Natural Gas prices hit a 7 year high of $6.25/MMBtu on concerns of a supply bottleneck.

- France is miffed about the canceled submarine deal and recalled ambassadors from the US and Australia.

- Norway has removed all Covid restrictions - now compares it to the Flu.

- China has banned all Cryptocurrency trading, transactions, and mining.

- Supply Chain problems got worse - the number of ships waiting in line to unload at California ports hit a record high of 65.

The Mortgage Economic Review is a concise summary of Key Economic Data that influences the Mortgage and Real Estate Industries. It's a quick read that keeps busy Professionals updated on important Economic Information. Feel free to share this with friends and colleagues in the Mortgage and Real Estate business. To have the Mortgage Economic Review emailed to you each month, click here.

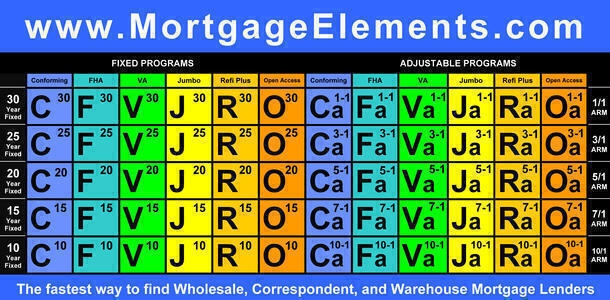

Discover new lending opportunities at MortgageElements.com, where you can explore over 300 Wholesale, Correspondent, Warehouse, Reverse, Construction, and Rehab Mortgage Lenders, from one website. Use the Mortgage Periodic Table to research Mortgage Products, view Underwriting Guidelines, and connect with Wholesale and Correspondent Account Executives - it costs nothing to use and is one of the industry's largest databases of TPO Mortgage Lenders.

Mark Paoletti, MortgageElements.com

The Mortgage Economic Review is for informational and educational purposes only and should not be construed as investment, legal, financial, or mortgage advice. The information is gathered from sources believed to be credible; some are opinion-based and editorial in nature. Mortgage Elements Inc does not guarantee or warrant its accuracy or completeness, and there is no guarantee it is without errors. This newsletter is created for use by Mortgage and Real Estate Professionals and is not an advertisement to extend credit or solicit mortgage originations. © Copyright 2021 Mark Paoletti, Mortgage Elements Inc, All Rights Reserved.