Mortgage Lending Hit 4-Year Low In August

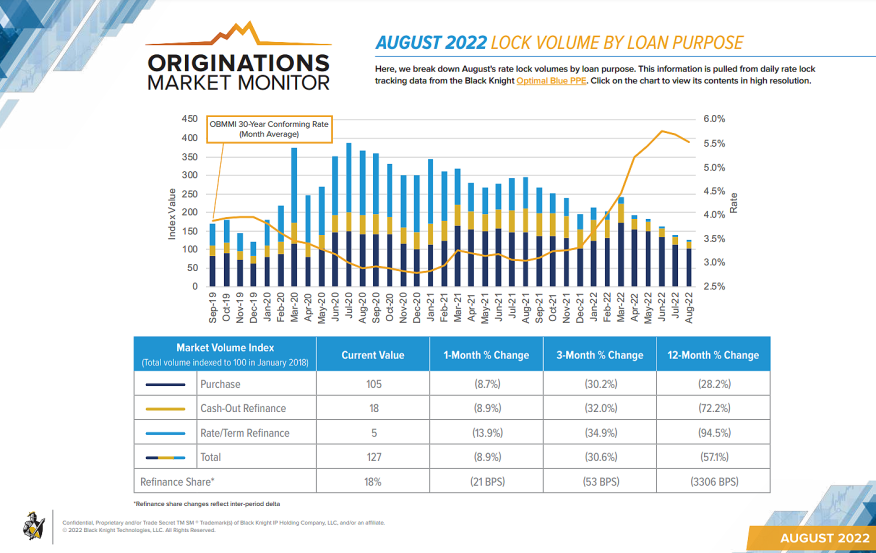

Black Knight reports that overall rate-lock volume is down 57% year over year.

- Overall rate locks in August fell 8.9% from July, and were down 57.1% year over year.

- Purchase locks, which now account for 82% of volume, were down 8.7% from July and 28.2% year over year.

- Rate/term refis fell 13.9%, while cash-outs were also down 8.9%.

Mortgage lending fell to a four-year low in August, as overall rate locks declined nearly 9% from July, according to a monthly report from Black Knight Inc.

The mortgage technology and data provider today released its Optimal Blue Mortgage Market Indices (OBMMI), a report that reviews a series of key market indicators to capture mortgage lending activity.

According to the OBMMI, overall rate locks in August fell 8.9% from July, and were down 57.1% year over year, as originations continued to adjust to affordability challenges and a higher rate environment. The benchmark 30-year rate crept back up through August to finish the month at 5.89%, a jump of 50 bps from July and the highest level since 2008. That drove home affordability to a new 35-year low, Black Knight said.

Rate/term refis fell 13.9%, while cash-outs — which had been somewhat insulated early in the rate cycle — were also down 8.9%. Even purchase locks, which now account for 82% of volume, were down 8.7% from July and 28.2% year over year, Black Knight said.

“Mortgage originators continue to feel the effects of interest rate and affordability challenges,” said Scott Happ, president of Optimal Blue, a division of Black Knight. “Facing headwinds of higher rates and a move into the traditionally slower purchasing months, rate-lock volumes fell nearly 9% overall in August to their lowest level since December 2019.”

“Purchase lock counts, which exclude the impact of soaring home values on volume, are off 30% from last year,” Happ continued. “That count is now down more than 16% from 2019, marking the second consecutive month the number of purchase locks have fallen below pre-pandemic levels, as well as the lowest August count in more than four years.”

Government-backed FHA and VA locks expanded market share over conventional and nonconforming products, Black Knight said. Borrower credit scores remained unchanged overall, with scores for cash-out refis rising three points to 695; scores on rate/term refinances dropping one point; and purchase scores remaining unchanged.

Purchases make up 82% of rate locks, the largest share since Optimal Blue began tracking the data in 2018. That is a result of high home prices, lack of inventory, and a higher rate environment, but those volumes are under pressure as well, Happ said.

“Interest rates rose again in August after retreating slightly in July,” he said. “This continues to have profound effects on home affordability, which returned to near 35-year lows to close out the month. As we reported last month, home prices have begun to pull back in some of the hotter home markets — particularly those on the West Coast. Likewise, we’ve observed declines in both the average purchase price and average amount financed in each of the past five months, with each now down 9% since March. We will keep a close eye on this trend as the market moves into the traditionally slower purchasing months ahead.”

The monthly Black Knight Originations Market Monitor draws information directly from origination pipelines, providing a comprehensive and timely sense of monthly market trends, Black Knight said.