'Congratulations, America'

After April spike due to calendar quirk, mortgage delinquencies in May fall back near all-time low.

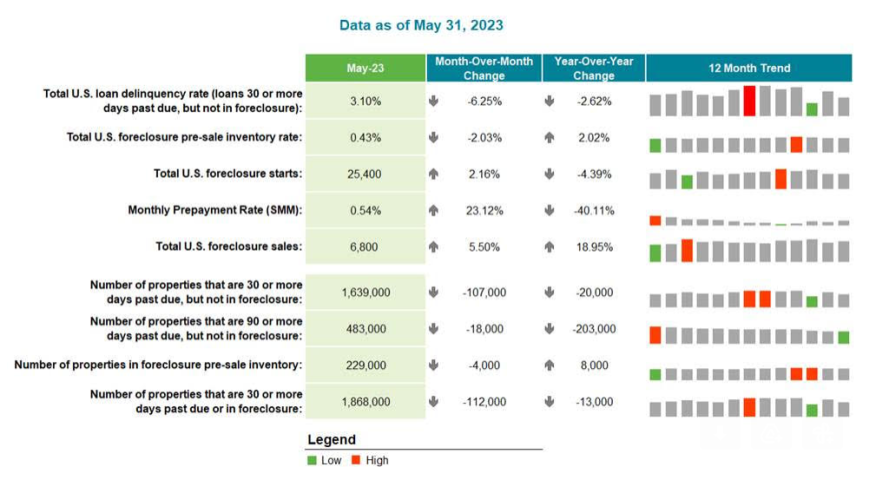

- After spiking 13% in April, delinquency rate fell to 3.1% in in May, one of the lowest on record.

- Number of borrowers who missed a single payment fell 9.5%, erasing nearly all of April's increase.

Following a 13% jump in mortgage delinquencies in April, the national delinquency rate fell 11 basis points in May to 3.1%, one of the lowest rates on record, Black Knight said Friday in its monthly First Look report.

The decline was anticipated, in part because the software, data, and analytics company said last month that April’s spike was largely due to a quirk in the calendar — the fact that April ended on a Sunday, which affects the processing of any payments made on the last calendar days of the month.

That had prompted Mitch Cohen, a Black Knight spokesman, to state that “much, if not all, of the spike would likely be reversed come May.”

Turns out, he was right.

“Congratulations, America,” Cohen quipped. “After climbing from a record low back up to 3.31% in April, the national mortgage delinquency rate dropped 11 bps to 3.1% in May. Keep in mind, if not for that record set in March, this would be the lowest we’d ever seen that number.”

The 3.1% rate is behind only March 2023’s record rate of 2.92%, he said.

In addition, the number of borrowers who were a single payment past due declined by 94,000, or 9.5%, erasing nearly half of April’s increase.

Serious delinquencies — loans that are 90 or more days past due — continued to improve nationally, falling by 18,000 (3.7%) from April. Serious delinquencies are now down more than 200,000, or nearly 30%, since May 2022, the company said.

Foreclosure starts increased 2.2% in May to 25,400, but remain near April’s six-month low and 41% below the same period in 2019, the last comparable May before the pandemic, Black Knight said.

Foreclosure actions were started on 5.1% of serious delinquencies in May, up only marginally from April and still more than a full percentage point below the March 2020 rate at the start of the pandemic.

The number of loans in active foreclosure fell by 4,000 from April and is now down 41,000, or 15%, from where it was in March 2020.

“On a final foreclosure note,” Cohen said, “the 6,800 foreclosure completions represented a 5.5% bump from April, and roughly 400 more in May than were completed the month prior.”

The report also noted that prepayment activity, which is historically driven largely by refinances and home sales, ticked up again in May as the market dealt with shifting interest rates.

“With a single-month mortality rate of 0.54%, prepayments hit their highest level since September of last year, when rates were in the low to mid-6s for much of the month,” Cohen said.

He added: “I find that minorly interesting, given that May 2023 rates hovered near 6.7% and yet we saw more prepays. But when all is said and done, activity is still down 40% from this time last year.”