Economists Less Confident Rates Will Drop Following Fed Decision

After sixth consecutive month with no change, the likelihood of cuts in 2024 feels "more out of reach."

Since inflation showing no signs of slowing down, the Federal Reserve showed no signs of cutting rates this week, affirming economists' predictions.

The Federal Open Market Committee held interest rates steady at 5.25% to 5.5% for the sixth consecutive time at the conclusion of its April/May policy meeting Wednesday. This was expected since inflation made little progress over the first three months of 2024, still failing to reach the Fed's 2% objective.

First American Senior Economist Xander Snyder said the Fed's decision to hold rates was “no surprise."

"With the economy and labor market proving resilient, and inflation ticking up again, the Fed seeks further assurance that inflation is headed sustainably towards its two-percent target before cutting rates," Snyder commented. "As a result, interest rates are again expected to remain ‘higher for longer.’”

He went on to point out that the Fed considers its dual mandate of targeting price stability and full employment when making rate decisions.

"The labor market currently appears to be at, or exceeding, full employment, despite the recent reacceleration of inflation. This means the Fed has little motivation to cut rates, as one of its mandates is already being fulfilled while the other is not.”

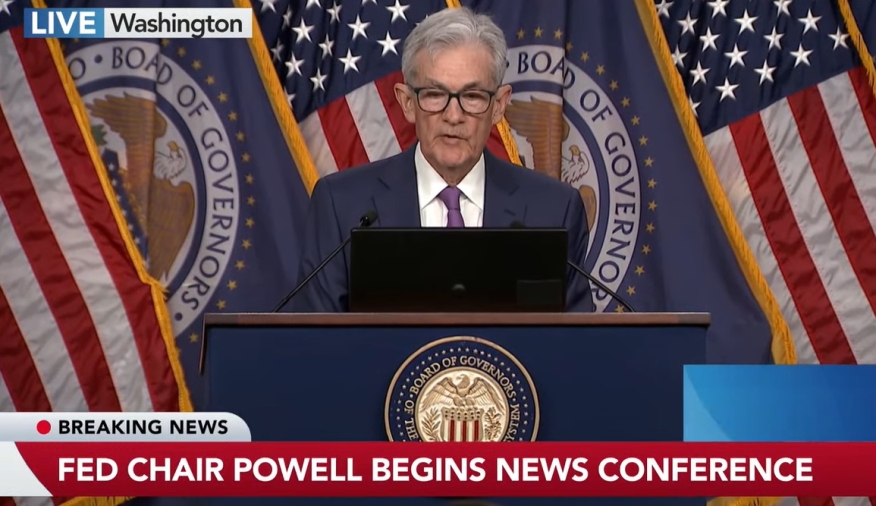

Fed Chairman Jerome Powell hinted that rates would stay intact during an April 16 policy forum, when he said the central bank would keep policy restrictive “as long as needed.”

“Inflation has eased substantially over the past year while the labor market has remained strong, and that’s very good news. But inflation is still too high, further progress in bringing it down is not assured and the path forward is uncertain,” Powell said in the press conference following Wednesday's meeting. “Restoring price stability is essential to achieve a sustainably strong labor market that benefits all. Our restrictive stance on monetary policy has been putting downward pressure on economic activity and inflation and the risks to achieving our employment and inflation goals have moved to better balance over the past year. However, in recent months inflation has shown lack of further progress to our 2% objective and we remain highly attentive to inflation risks.”

CoreLogic Chief Economist Dr. Selma Hepp had an optimistic take on Wednesday's announcement.

"The Fed is signaling with today’s announcement that there isn’t enough confidence that inflation will continue to drop toward the 2% target," Hepp said. "We will continue to observe interest trends, but we don’t expect a meaningful dip in mortgage rates for the remainder of the year. What is promising, however, is that some markets are showing an increase in inventory, especially on the lower end of home prices. That is the light at the end of the tunnel for the housing market right now."

The Fed is continuing to reduce its securities holdings, lowering the monthly redemption cap on Capital and Treasury securities from $60 billion to $25 billion as of June 1. The monthly redemption cap on agency debt and agency mortgage‑backed securities will remain at $35 billion, as the committee reinvests any principal payments in excess of this cap into Treasury securities.

“Lower mortgage rates continue to feel more out of reach in this perfect storm of persistent inflation, rising treasury yields, and the Fed’s continued runoff of its MBS holdings," commented Fitch Ratings Senior Director Eric Orenstein.

Policy rate decisions depend on different paths the economy takes, given various factors, Powell told media.

“Two of those paths would be that we do gain greater confidence that inflation is moving sustainably down toward 2%, and another path could be an unexpected weakening in the labor market, for example,” he said. “Those are paths in which you could see us cutting rates. It will really depend on the data.”

Officials went on to say that they will continue to assess inflationary pressures, financial developments and labor market conditions and are prepared to make policy adjustments if risks to their 2% inflation goal emerge.