How To Help LGBTQ+ Renters Become Homeowners

Redfin says this buying segment feels lack of family support is significant.

It’s a common claim among mortgage lenders that they want you to feel like part of the family. If sincere, that approach could work well with LGBTQ+ renters who say lack of family support is holding them back from becoming homeowners, according to a Redfin story,

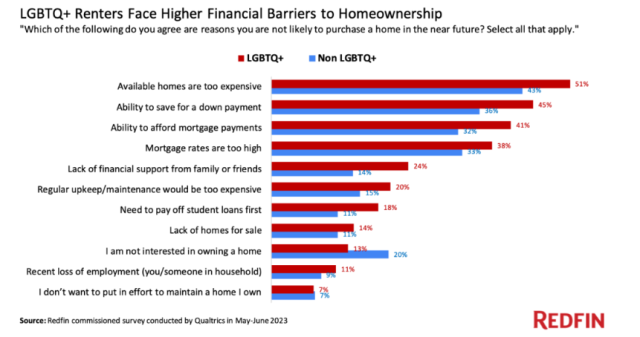

LGBTQ+ renters are more likely to face financial barriers to homeownership than non LGBTQ+ renters, according to a survey commissioned by Redfin (redfin.com), the technology-powered real estate brokerage. Nearly one-quarter of LGBTQ+ renters (23.5%) said they’re unlikely to buy a home in the near future due to lack of financial support from family or friends, compared with 14% of non LGBTQ+ renters—the largest gap among the barriers respondents chose from.

“Young people are often rewarded financially for fulfilling heteronormative expectations around getting married and having kids,” Redfin Chief Economist Daryl Fairweather said. “For example, it’s common for a bride and groom to receive thousands of dollars in cash gifts when they get married, which they can put toward buying or renovating a home. LGBTQ+ couples, on the other hand, often get married later in life, and may not receive financial support if they’ve been shut out by their families.”

As reported in the June issue of National Mortgage Professional Magazine, homeownership rates continue to be lacking in the LGBTQ+ community. According to U.S Census data and Freddie Mac, the rate among those ages 22 to 72 who identify as LGBTQ+ is just 49%, compared to the overall U.S. general population rate of 65%. In 2021, 12% of homebuyers identified as LGBTQ+. The National Association of Realtors reports those homebuyers are likely to be first-time buyers compared to the demographic of non-LGBTQ+ buyers.

Andrew Dort, broker and owner, Pride Lending, offers advice for loan originators in the same article. He says, that approaching customers in the LGBTQ+ community shouldn’t be that hard or different from any other customer. “The point is to make their homebuying experience as normal as possible without them having to worry about being judged,” he said. “You treat every customer equally. There aren’t many spaces outside of queer spaces that take into account that not every couple is straight or that someone’s legal name isn’t their preferred name.”

LGBTQ+ renters were also more likely than non LGBTQ+ renters to say student loan debt is preventing them from buying a home (18.4% vs 11.4%).

More than half (51.2%) of LGBTQ+ renters said they’re unlikely to buy a house soon because homes are too expensive, compared with 43.1% of non- LGBTQ+ renters. Similarly, 44.9% of LGBTQ+ renters cited saving for a down payment as an obstacle, versus 35.7% of non LGBTQ+ renters. For virtually every barrier listed, LGBTQ+ respondents were more likely than non LGBTQ+ respondents to check the box.

One answer choice bucked the trend: LGBTQ+ renters were less likely (13.2%) than the non LGBTQ+ renters (20.1%) to say they’re unlikely to buy a home in the near future simply because they’re not interested in owning one.

Redfin also surveyed people who bought a home in the past year to see how they saved up for down payments. Recent LGBTQ+ homebuyers were more likely to say they worked a second job (29.1% vs 18.3% of non LGBTQ+ buyers), sold stock investments (18.5% vs 13.8%) and sold cryptocurrency investments (14.8% vs 8.5%). They were also more likely to save directly from paychecks (46.6% vs 36.5%).

The wage gap is likely one reason LGBTQ+ buyers are more likely to take on a second job to fund their down payment; LGBTQ+ workers earn about 90 cents for every dollar the typical worker earns, according to the Human Rights Campaign.