Legacy Of Redlining Still Impacting Minority Households

Zillow report shows discrepancies in credit insecurity.

Black families are paying more to rent their place of residence than they would owning a home due to credit insecurity, revealed a recent report that points to ongoing redlining.

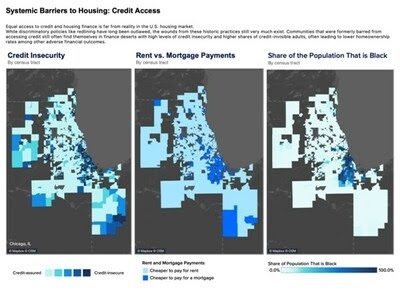

New maps published by Zillow Research showed that among Americans bearing the nation’s $600 billion total share of rental payments, black households are particularly impacted.

"Lack of credit access keeps people in a cycle of paying more in rent than they would pay each month for a mortgage on that same home," said Nicole Bachaud, senior economist at Zillow. "Communities of color, particularly Black families, see this play out, keeping a path to economic stability and wealth generation locked.

Bachaud went on to urge policymakers to take action improving families’ access to credit.

Analysts said that access to traditional and safe credit building is limited in many neighborhoods, so even those who can afford a monthly mortgage payment have not established the credit they need to qualify. As a result, they are actually paying more to rent than they would to own a home.

The Zillow maps illustrate how credit-insecure census tracts are directly linked to the share of the population that is Black, and to the areas where rent payments surpass the cost of home mortgages.

The city where this is most prevalent is New Orleans, where the income-adjusted gap between the cost of a typical rental and a mortgage payment on a typical home is the widest in the U.S. In New Orleans' credit-insecure census tracts - where 56.7% of the population is Black - a median renter household spends 77.5% of its income on a typical rental, but the average homeowner spends just 28.6% on a mortgage payment.

Though prohibited by law, this speaks to the legacy left by redlining practices, when housing-related services were withheld from people living in certain neighborhoods. Ethnic and racial minorities as well as low-income people were adversely affected.

The Justice Department in late October revealed significant advancements in its Combating Redlining Initiative, amassing over $107 million in relief to counteract lending discrimination faced by communities of color across the U.S. One component of this relief is the $9 million settlement with Ameris Bank, resolving claims of redlining practices primarily against Black and Hispanic communities in Jacksonville, Fla.

Zillow analysts encouraged policymakers to take action on this issue by incentivizing financial institutions and landlords to report positive rent payments and for government-sponsored agencies to consider this data as credit-worthy.