MBA: IMBs Lost 30% Less On Loans Originated In Q1

32% of companies were profitable in Q1, up from 25% in Q4.

- IMBs and mortgage subsidiaries of chartered banks reported a net loss of $1,972 on each loan originated in Q1.

- That was up from a reported loss of $2,812 per loan in the Q4 2022.

- Costs continued to escalate with the further drop in volume, reaching more than $13,000 per loan.

Independent mortgage banks (IMBs) and mortgage subsidiaries of chartered banks lost 30% less on each loan they originated in the first quarter of 2023, the Mortgage Bankers Association (MBA) said Thursday.

According to the MBA’s Quarterly Mortgage Bankers Performance Report, IMBs and mortgage subsidiaries of chartered banks reported a net loss of $1,972 on each loan they originated in the first quarter, up from a reported loss of $2,812 per loan in the fourth quarter of 2022.

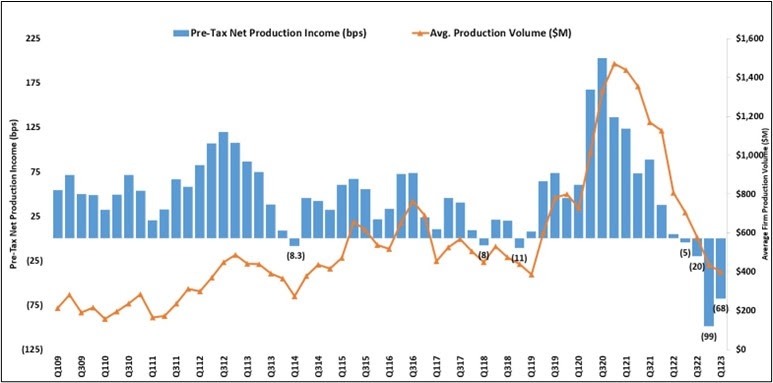

“A net production loss of 68 basis points in the first quarter of the year is an improvement over the record 99-basis-point loss reported in the fourth quarter of 2022,” said Marina Walsh, CMB, MBA’s vice president of industry analysis. “Conditions continue to be challenging for the industry, with now four consecutive quarters of production losses and nine consecutive quarters of volume declines.”

Walsh did cite one silver lining. “Production revenues improved by 40 basis points,” she said. “However, costs continued to escalate with the further drop in volume and reached more than $13,000 per loan despite substantial personnel reductions.”

She noted that, including both the production and servicing business lines, 32% of companies were profitable last quarter, up from 25% in the previous quarter.

Key highlights of the report:

- The average pre-tax production loss was 68 basis points (bps) in the first quarter of 2023, compared to an average net production loss of 99 bps in the fourth quarter of 2022, and down from a gain of 5 basis points one year ago. The average quarterly pre-tax production profit, from the third quarter of 2008 to the most recent quarter, is 48 basis points.

- The average production volume was $398 million per company in the first quarter, down from $436 million per company in the fourth quarter. The volume by count per company averaged 1,264 loans in the first quarter, down from 1,395 loans in the fourth quarter.

- Total production revenue (fee income, net secondary marketing income and warehouse spread) increased to 358 bps in the first quarter, up from 317 bps in the fourth quarter. On a per-loan basis, production revenues increased to $11,199 per loan in the first quarter, up from $9,637 per loan in the fourth quarter.

- The purchase share of total originations, by dollar volume, remained unchanged at a study high of 88% in the first quarter. For the mortgage industry as a whole, MBA estimates the purchase share was at 80% in the first quarter of 2023.

- The average loan balance for first mortgages increased to $329,159 in the first quarter, up from $322,225 in the fourth quarter.

- Total loan production expenses — commissions, compensation, occupancy, equipment, and other production expenses and corporate allocations — increased to a study-high of $13,171 per loan in the first quarter, from $12,450 per loan in the fourth quarter of 2022. From the third quarter of 2008 to last quarter, loan production expenses have averaged $7,172 per loan.

- The average number of production employees per company declined from 413 in the fourth quarter of 2022 to 374 in the first quarter of 2023 (on a repeater company basis).

- Servicing net financial income for the first quarter (without annualizing) was $54 per loan, up from $37 per loan in the fourth quarter. Servicing operating income — which excludes MSR amortization, gains/loss in the valuation of servicing rights net of hedging gains/losses, and gains/losses on the bulk sale of MSRs — was $102 per loan in the first quarter, down from $104 per loan in the fourth quarter.

MBA's Mortgage Bankers Performance Report is intended as a financial and operational benchmark for independent mortgage companies, bank subsidiaries, and other non-depository institutions. Of the 312 companies that reported production data for the first quarter of 2023, 84% were independent mortgage companies; the remaining 16% were subsidiaries and other non-depository institutions.