NAF Releases New White Paper On Empowering Diverse Communities

Addressing the racial homeownership gap and recommending industry-wide solutions

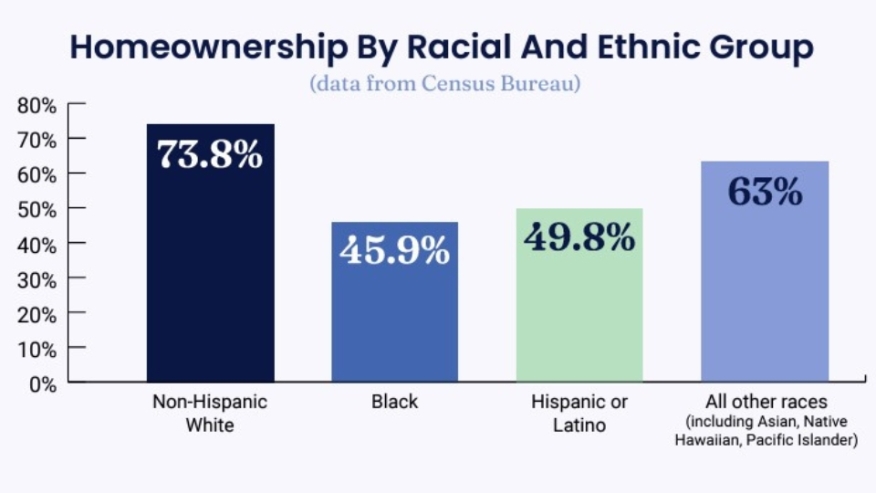

The overall homeownership rate across the US stands at 66%, with notable differences among racial and ethnic groups. New American Funding (NAF), the largest Latina-owned mortgage company in the U.S., is taking steps to close that homeownership gap by addressing systemic obstacles that have kept many diverse communities from building generational wealth.

On April 25, NAF announced the release of a new white paper: "Empowering Homeownership in Diverse Communities," which examines the economic inequalities, cultural and social factors, and institutional barriers that have widened the gap in homeownership between racial and ethnic groups.

According to data from the US Census Bureau, Non-Hispanic Whites lead with the highest homeownership rate at 73.8%. Hispanics or Latinos are at 49.8%, Black Americans at 45.9%, and all other races, including Asian and Pacific Islander communities, at 63%. The NAF white paper calls for a concerted effort to dismantle historical and systemic obstacles to homeownership.

The white paper takes into account factors such as redlining, income inequality, credit accessibility, and other influences that contribute to the challenges faced by those in diverse communities. In addition to an in-depth analysis of the factors causing the homeownership gap, the white paper highlights specially tailored solutions to address these challenges, overcome disparities, and create equal opportunity. That includes hiring practices that mirror community demographics, offering tailored lending solutions, and engaging in strategic partnerships with organizations that support economic empowerment.

"Our mission at New American Funding is not just about numbers and transactions; it's about dismantling the barriers that have historically denied so many the opportunity to own a home," said NAF Co-Founder and CEO Patty Arvielo. "We are unwavering in our commitment to create a seismic shift in the landscape of homeownership. The reasons for this gap are complex, and while numerous hurdles still exist, there are tangible, achievable solutions creating permanent and positive change in this country right now."

Under Arvielo, NAF has driven record recruitment of Black and Latino loan officers and mortgage professionals, the press release stated. And the company is committed to providing access to affordable and sustainable financing options to those who have been historically marginalized and overlooked by the traditional lending industry.

The paper also debunks many misconceptions about the homeownership gap, such as whether those in certain communities do not desire to own their own home, or that homebuyers in certain populations are a greater lending risk than others.

"Discrimination, restricted credit access, and underrepresentation have led to a substantial gap in homeownership and the ability to build generational wealth," said Mosi Gatling, NAF's Senior Vice President of Strategic Growth and Expansion. "At NAF, we are developing programs that simplify and improve access to homeownership. We meet individuals where they are and provide support to uplift them.”