What To Know Before Entering The Wholesale Channel

STRATMOR Group's May Insights Report analyzes wholesale lending opportunities for lenders and LOs.

Loan officers and retail and consumer-direct lenders thinking about moving into the wholesale channel have many factors to consider, according to STRATMOR Group.

In its May Insights Report, the Denver-based consulting group includes an article STRATMOR partner Jim Cameron titled, “Thinking About Wholesale? Considerations for Mortgage Originators and Lenders,” in which he reviews the factors and provides research, data, and analysis to help in making a decision.

He poses the key questions originators should ask themselves when making a decision to switch channels. These include: What is the earnings potential? Can an originator make more money working with a retail lender or as a broker? He then lays out a proforma summary reflecting the economics of each originator category.

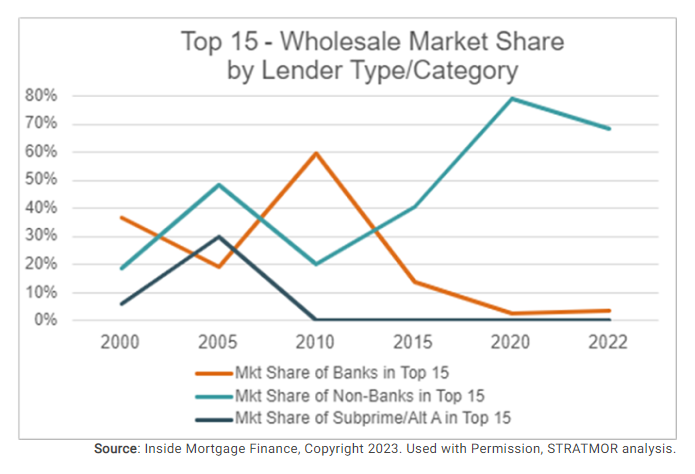

Cameron explains why the wholesale market share of the total origination market peaked at 56% in 2006, and has normalized into the 16%-to-21% range since 2018. The real trend to watch, he adds, has been the consolidation of market share among the top three players, which now comprise over 50% of total wholesale volume.

“The combined market share of the top three wholesale lenders has generally trended upward since 2000, except for 2015,” he said. “As banks exited the channel in the 2010-to-2015 timeframe, the wholesale channel’s top three lenders’ share dropped. In 2015, the top three concentration increased from 2015 to 2020, led by UWM, Rocket and Home Point. Today the top three wholesale lenders’ market share concentration is still well above 50%.”

Lenders looking for additional revenue may find the idea of increasing variable costs and reducing fixed costs appealing, Cameron said. Lenders that choose to compete in the wholesale channel will typically do so using one of three strategies: scale, niche, or relationship.

Scale wholesale lenders, like UWM and Rocket, control the largest share of the market and offer their brokers better pricing and technology, primarily on plain agency loans, Cameron said.

Niche wholesale lenders, meanwhile, offer products that require specialized expertise, which makes it more difficult to scale. For example, Non-QM lenders like Angel Oak or Deephaven offer non-agency products that have unique underwriting and investor requirements, he said.

“The wholesale channel is ideal for niche lenders, because they can cast a wide net over thousands of brokers who can originate the product as the need arises, and work with a lender who has the expertise to efficiently underwrite and close the loan,” he said.

Relationship wholesale lenders have long-term relationships with counterparties that broker loans to them, such as smaller community banks and credit unions that need high-touch service and value one-on-one relationships with only one wholesale partner. While not offering the volume of scale wholesale lenders, this strategy “could be a nice supplemental channel for an existing retail lender,” Cameron said.

“Lenders considering the wholesale channel should consider whether they can build a sustainable competitive advantage in their chosen segment: scale, niche or relationship,” he said.

Cameron’s article also addresses what drives loan originators to move to the broker wholesale model. He said that, of the three models of lenders — consumer direct (CD), distributed retail and mortgage broker — originators working in consumer direct call centers who do not build their own book of business are unlikely to move, but other originators might.

“It is much more plausible for a retail originator to pivot to become a mortgage broker or vice versa,” he said. “After all, they are doing much the same thing — beating the bushes to generate business, whether they are employed by a retail lender or a mortgage broker.”