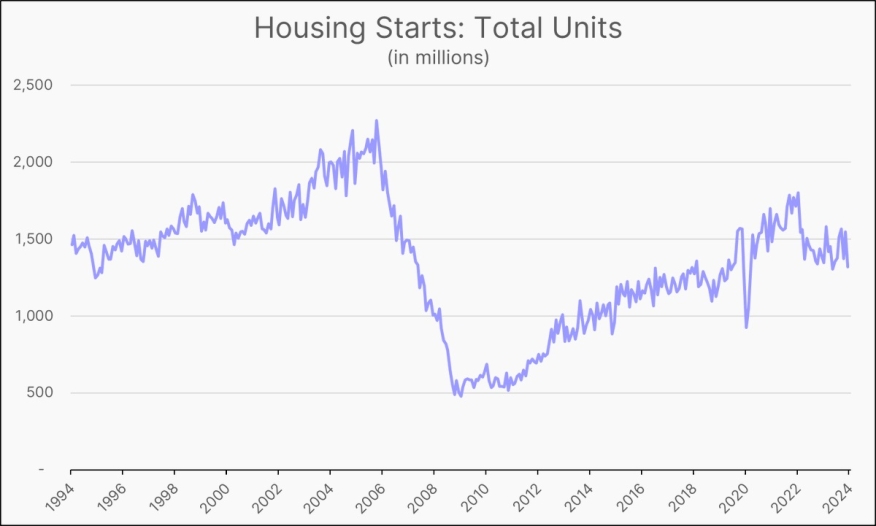

Housing Starts Down 4.3% YOY

March’s single-family housing starts came in at 1,022,000, per the U.S. Census Bureau

March’s single-family housing starts came in at 1,022,000, dropping 12.4% below February’s revised figure of 1,167,000, the U.S. Census Bureau reported. This is down 4.3% year-over-year.

Privately-owned housing starts in March were at 1,321,000, down 14.7% from February’s revised estimate of 1,549,000, and down 4.3% YOY.

Privately‐owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 1,458,000. This is 4.3% below the revised February rate of 1,523,000, but 1.5% above the March 2023 rate of 1,437,000.

Single‐family authorizations came in at a rate of 973,000, or 5.7% below February’s revised figure of 1,032,000.

Overall, total housing starts in March were well below expectations, although starts in January and February were up slightly once revised.

Housing completions have declined even more significantly, with single-family completions at a rate of 947,000, 10.5% below February’s revised rate of 1,058,000. The seasonally adjusted March rate for privately‐owned housing completions was 1,469,000, 13.5% below the revised February estimate of 1,698,000 and 3.9% below the March 2023 rate of 1,528,000.

This speaks to the nation’s ongoing struggle with housing affordability, analysts say, especially since the decline in starts was most severe for multi-family housing, at -20.8%.

“While renters will have more choices this year, the future supply pipeline of apartments (as measured by apartment starts) is now also falling, and in the long run there is still a national housing shortage,” said Odeta Kushi, chief economist at First American.

Overall, the U.S. is currently undersupplied by about 3 million housing units, according to First American data.

Kushi is hopeful that the 940,000 units currently under construction will help relieve some of the shortage.

“Many of these apartments are coming to market now," she said. "As a result, we can expect the surge in new apartment supply to continue throughout this year and into the first half of 2025.