UWM, UMortgage Under Attack For Alleged Shell Scheme

A report released on April 25 by the hedge-funded media company alleges UWM set up a shell company, UMortgage.

Just weeks after allegations against United Wholesale Mortgage (UWM) were published in an exposé-style report and a class action lawsuit, Hunterbrook Media is once again putting the Michigan lender under the spotlight.

On Thursday, the hedge-funded media company published its latest report, “UWM’s Shell Game: How United Wholesale Mortgage Executives Helped Create An ‘Independent’ Company That Has Sent UWM An Estimated $1.9 Billion In Loans,” alleging UWM’s Chief Strategy Officer Alex Elezaj set up a shell company used to purchase and establish UMortgage in 2019.

The financing via the shell company, which Elezaj owned until at least 2020, allowed Anthony Casa to buy UMortgage and become its CEO two years after he exited personal bankruptcy.

Hunterbrook claims that UMortgage, which operates in 48 states and the District of Columbia, acted as a “reliable funnel of loans to UWM,” the report read. “Elezaj appeared on UMortgage filings until 2020 — when it appears he transferred his stake to Casa, just before UWM’s public listing through a SPAC transaction.”

The report continued, “In the last three years, UMortgage sent UWM an estimated 77% of its loans, totaling an estimated $1.9 billion, according to Hunterbrook Media’s analysis of 2021, 2022, and 2023 county and federal-level mortgage data.”

UMortgage former branch manager and senior loan originator for UMortgage, Lyndsey Johnson, told Hunterbrook that UMortgage’s leadership allegedly “manipulates its rate sheets” to make UWM’s loans appear cheaper than those from other lenders — “without telling the UMortgage loan originators whose responsibility it is to shop for the best deal on behalf of clients,” Johnson claimed.

Additionally, Johnson claimed that UMortgage often charges more in upfront fees than a traditional broker and pushes homebuyers to UWM over other lenders.

In the Hunterbrook article, Johnson alleged that “UMortgage would add 100-basis-point ‘negative price adjustments’ to other lenders ‘in the back end’ of the software its loan officers used to compare lender offers. That way, UWM would show up at the top of the rate sheet.”

Casa is known for his creation of the Association of Independent Mortgage Experts (AIME), which he resigned from in October 2020 following a lawsuit in which he “published and distributed derogatory, misogynistic and per se defamatory material” including videos and texts about the wife of an executive at Rocket Mortgage.

Hunterbrook noted in its report that after Casa stepped down, AIME reported an unspecified $500,000 settlement payment, according to tax filings seen by Hunterbrook Media.

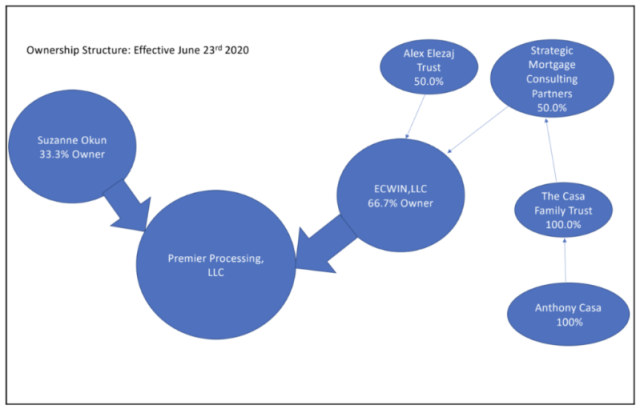

Casa’s financial history is also touched upon in the report. Just a few years after declaring bankruptcy, in 2019, Casa contributed at least $300,000 to a shell company called ECWIN, LLC., which bought the entity that would later be renamed UMortgage from its prior owner, Suzanne Okun. Hunterbrook noted that Okun previously worked as a consultant for Shore Mortgage, as UWM was previously known.

Casa was co-owner, the second being Elezaj, who Hunterbrook writes “infused $300,000 into the company through a trust on the eve of its purchase of UMortgage.”

UWM and Anthony Casa did not immediately respond to a request for comment.