N.Y. congressman says selling the information increases risk of fraud, ID theft.

Trigger leads on mortgage applications could be outlawed if a New York congressman gets his way. The practice, he claims, causes mortgage fraud and identity theft.

U.S. Rep. Ritchie Torres, D-N.Y., has introduced the Trigger Leads Abatement Act of 2022. The proposed legislation (HB 7661) states, “No consumer reporting agency may furnish a consumer report in connection with a credit transaction that is not initiated by a consumer, if the report is being procured based in whole or in part on the presence of an inquiry made in connection with a residential mortgage loan.”

Speaking with Spectrum News NY1, The Bronx Democrat said, “We have to ask ourselves a simple question: Should businesses have the right to share your personal information, without your knowledge and consent?”

This has been an ongoing issue since at least 2018. As previously reported by National Mortgage Professional, trigger leads are created and sold by the national credit bureaus. These leads are comprised of names, contact information, and other data, including a significant amount of personal information, for individuals who have recently applied for a mortgage.

The NY1 article added, “Some argue these are helpful for consumers, providing them with a better sense of their options, including possibly better rates. But others worry they can lead to consumers being manipulated.”

“The reality of trigger leads is that it often leads to more identity theft, fraud, and predatory lending,” said Torres, who introduced his bill earlier this month.

The Consumer Data Industry Association defends trigger leads. The CDIA represents consumer reporting agencies, including the nationwide credit bureaus, regional and specialized credit bureaus, background check companies, and others.

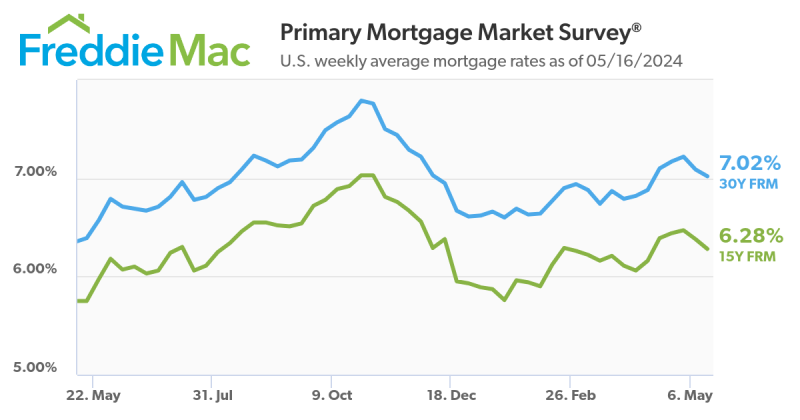

“Lenders making timely credit offers can maximize consumers’ choices when they need it most. When shopping for a mortgage this can mean saving thousands of dollars,” said Justin Hakes, the CDIA’s vice president for communications and public affairs. "In a time when interest rates and housing prices are going up, this can help people afford the right home for them."

A Torres spokesperson said the representative is not deterred by prior legislative failures on this issue. She said, “As a member of the Financial Services Subcommittee on Consumer Protection and Financial Institutions, he is intent on passing legislation that protects consumers’ right to their own private information.”