Homeowners Insurance A Growing Concern in Florida and California

Majority of Fla. and Calif. survey respondents have been affected by insurance woes or live in an area that has, Redfin says

Insurance is at the top of mind for homebuyers and homeowners in Florida and California, which have become epicenters of the nationwide housing insurance crisis.

Rising homeowners insurance premiums and changes in coverage are so commonplace now that nearly three-quarters (70.3%) of Florida homeowners and over half (51%) of those in California say they or the area they live in has been affected.

That compares with less than half (44.6%) of homeowners nationwide, according to a new report from Redfin, which is based on a Qualtrics survey the brokerage commissioned in February 2024.

“Homeowners living in areas where insurance premiums are surging are at risk of seeing their properties gain less value than homeowners in areas with stable premiums— and in some cases, they may even lose money,” said Redfin Chief Economist Daryl Fairweather. “Homes with low disaster risk and low insurance costs will likely become increasingly popular, and thus more valuable, as the dangers of climate change intensify.”

Many of the largest property insurers have recently opted to limit new policies in these two states due to wildfire and flood risks, including seven companies in California and 11 in Florida.

In Florida, 11.9% of survey respondents who plan to move in the next year cited rising insurance costs as a reason— roughly twice the national share of 6.2%. In California, 13.1% of people with relocation plans this year cited concern for natural disasters or climate risks as a reason, compared with 8.8% of respondents nationwide.

Among the 2,995 U.S. homeowners and renters who responded to the survey, 1,198 indicated they or their area has been impacted by these issues. Within that large group, 12% of Florida respondents and 10.7% of California respondents said their insurance company stopped offering coverage for their homes, compared to 8.3% of respondents nationwide.

As condo prices in Florida drop due to the lessening demand from buyers, some homeowners are simply opting to stay put in the state, uninsured or underinsured. Those who haven’t been dropped by carriers yet are growing anxious about this possibility. In Florida, 27.7% of participants share this concern; in California, it’s 13.5%.

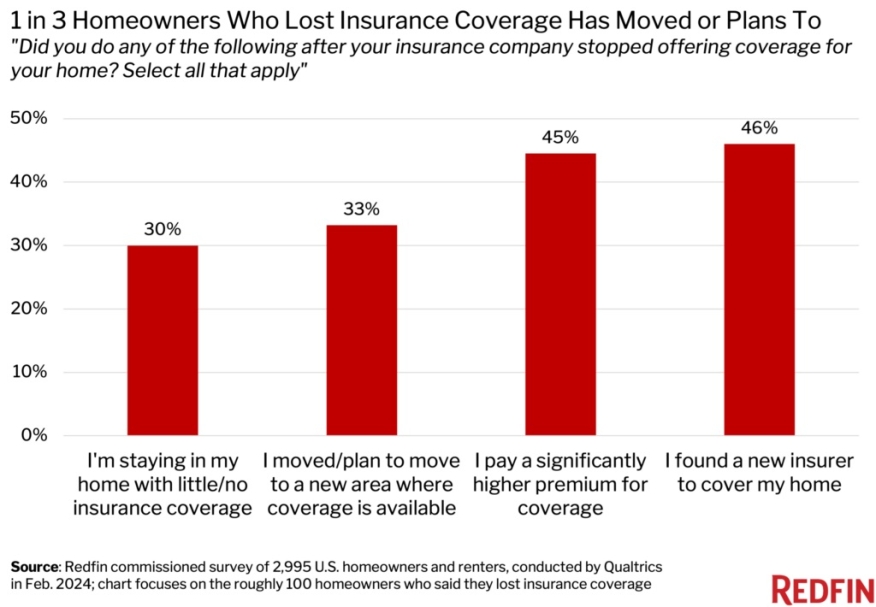

Among homeowners whose insurers stopped covering their homes, 33.2% moved or plan to move to a new area; 30% are staying in their home with little or no coverage; 46% have found a new insurer and 44.5% said they pay a significantly higher premium for coverage than before. Many of those have opted for the pricey state-sponsored plans, such as California’s FAIR Plan and Florida’s Citizens Property Insurance Corp.

Overall, nearly three-quarters of respondents (71.7%) said their policy premium has increased, including 76% of Florida residents and 62.9% of those from California.

The average annual home insurance rate is expected to rise 6% this year to $2,522, according to Insurify. That rate is higher in Florida than any other state, at $10,996.

Fairweather encouraged homeowners to review their existing coverage so they are prepared for any and all unforeseen events that may impact those plans.