Borrowers File Class Action Lawsuit Against UWM

Plaintiffs claim that UWM cheated hundreds of thousands of borrowers out of billions of dollars.

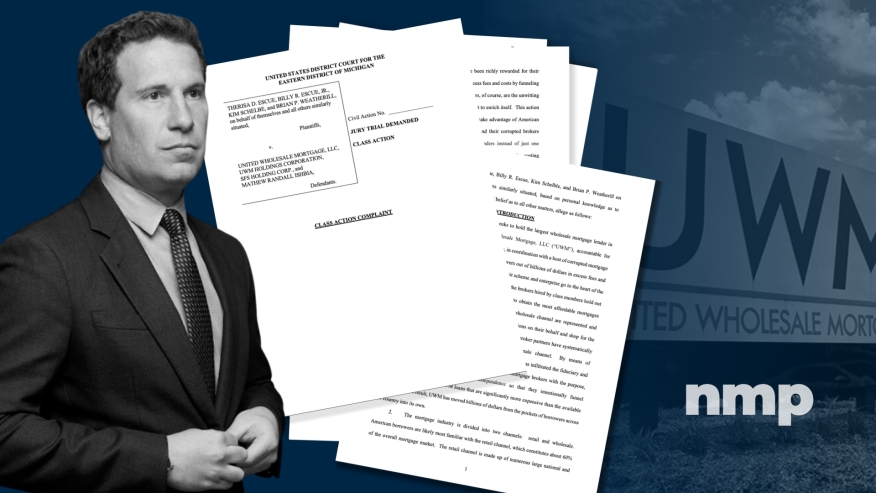

Borrowers filed a class action lawsuit against United Wholesale Mortgage (UWM) and CEO Mat Ishbia, alleging the lender violated the RICO Act and the Real Estate Settlement Procedures Act (RESPA), civil conspiracy and unjust enrichment among other claims.

The lawsuit was filed on April 2 in the United States District Court for the Eastern District of Michigan, and the summons was issued April 3. The plaintiffs Therisa D. Escue, Billy Escue, Kim Schelbe, and Brian P. Weatherill, filed on behalf of themselves and all others similarly situated.

The lawsuit claims UWM should be held accountable “for orchestrating and executing a deliberate scheme, in coordination with a host of corrupted mortgage brokers, to cheat hundreds of thousands of borrowers out of billions of dollars in excess fees and costs that they paid to finance their homes.”

The plaintiffs state in the filing that independent mortgage brokers are meant to be independent, unlike a loan officer at a retail lender.

“An ‘independent’ mortgage broker owes loyalty to the borrower, not the bank. And because the broker is not tied to any particular lending institution, the broker can collect and present options from many different lenders to ensure the borrower receives the most competitively priced options in their best financial interest,” the lawsuit states.

In 2021, UWM issued an ultimatum to all of its broker partners stating they can either choose to do business with UWM or their rivals, Rocket Pro TPO and Fairway Independent Mortgage, but cannot continue to do business with both. Since the ultimatum was issued, a number of lawsuits have been filed between brokers and UWM for allegedly violating the ultimatum. Broker partners who breach the ultimatum are required to pay liquidated damages in the amount of $5,000 per loan closed with UWM, or $50,000, whichever is greater.

The lawsuit quotes Ishbia saying that UWM’s broker partners are “completely independent” and that brokers have the ability to shop around among their choice of wholesale lenders.

However, the complaint alleges that nearly half of all UWM mortgages are originated by brokers who refer 75% or more of their business to UWM.

“Over the past three years, UWM has issued nearly $39 billion in mortgages through ‘independent’ brokers who refer 99% of their business to UWM. And during last year alone, more than 8,000 so-called 'independent' brokers funneled 99% or more of their mortgages to UWM, worth at least $11.7 billion," the lawsuit read.

The lawsuit was filed the same day a new media firm, Hunterbrook, published an investigative article on UWM that contains similar allegations as those mentioned in the lawsuit.

"Accountability requires action. That's why the Hunterbrook Foundation shared research with Boies Schiller Flexner — and we hope homeowners have a path to restitution for what our data analysis indicates could be substantial damages," said Hunterbrook Media Publisher Sam Koppelman.

The plaintiffs allege that the consequences of UWM’s alleged misconduct have been “devastating,” claiming that UWM rarely offered the best available pricing throughout the past four years and routinely charged fees that substantially exceeded their competitors’ offerings to the tune of billions of dollars.

UWM shared a statement with NMP in an email that read "The lawsuit filed yesterday is a sham. Although the real party behind it is a hedge fund named Hunterbrook, the lawyers concealed the hedge fund’s involvement. Hunterbrook’s business model is to sensationalize public information to manipulate the stock market, thereby enriching their wealthy funders at the expense of regular investors, many of whom are hard-working UWM employees. UWM will defend these allegations to the fullest extent permitted by law and stands with the thousands of independent mortgage brokers who serve the unique needs of borrowers across the country."

The plaintiffs are seeking damages in an amount to be determined at trial.