Home Prices Keep Rising, but Available Credit Barely Expands

Home prices are still in ascension, but mortgage credit availability is barely inching up, according to a pair of new data reports issued this morning.

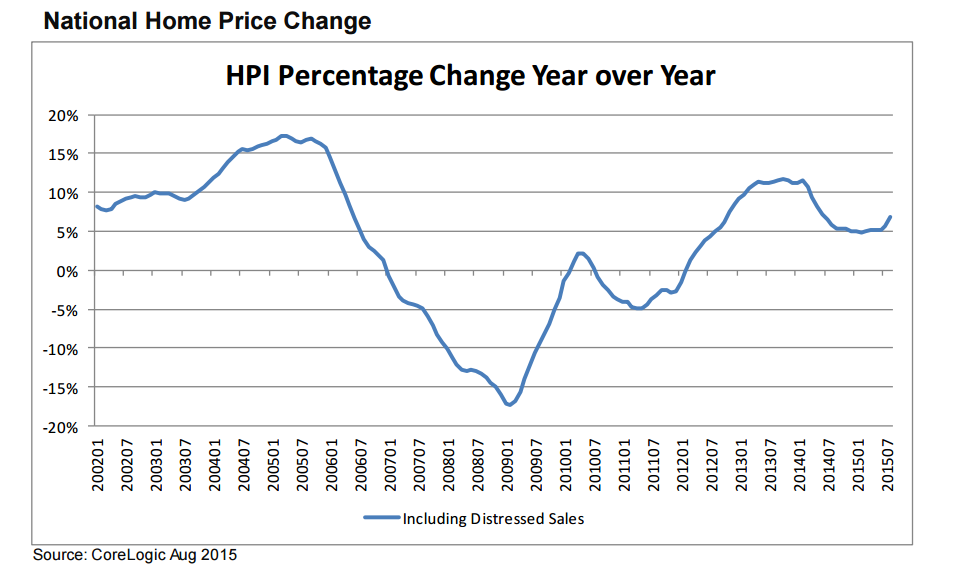

The CoreLogic Home Price Index and Forecast for August found home prices up 6.9 percent on a year-over-year basis and up 1.2 percent on a month-over-month basis (data includes distressed sales). CoreLogic is projecting home prices to rise 4.3 percent on a year-over-year basis by August 2016, but the company is also projecting unchanged levels for September’s sales.

"Home price appreciation in cities like New York, Los Angeles, Dallas, Atlanta and San Francisco remain very strong reflecting higher demand and constrained supplies," said Anand Nallathambi, president and CEO of CoreLogic. "Continued gains in employment, wage growth and historically low mortgage rates are bolstering home sales and home price gains. In addition, an increasing number of major metropolitan areas are experiencing ever-more severe shortfalls in affordable housing due to supply constraints and higher rental costs. These factors will likely support continued home price appreciation in 2016 and possibly beyond."

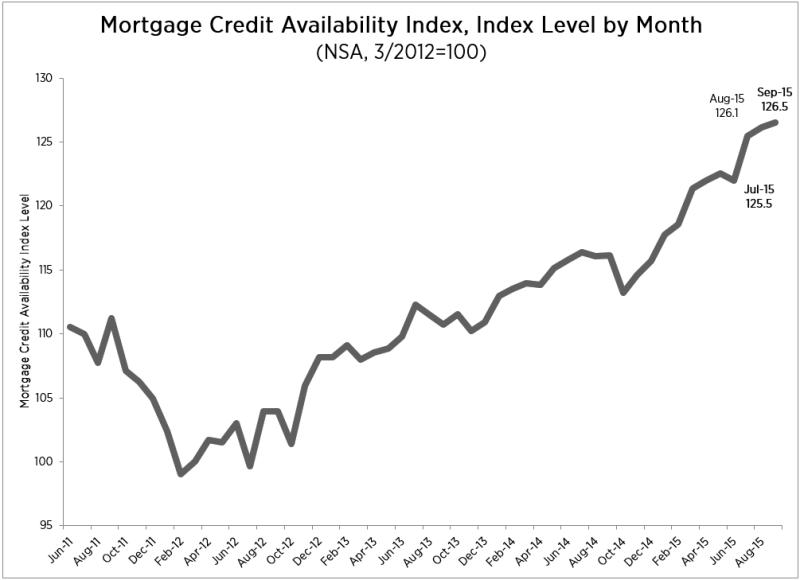

Separately, the Mortgage Credit Availability Index (MCAI) published by the Mortgage Bankers Association (MBA) increased by a scant 0.3 percent to 126.5 in September. Of the four component indices, the Conventional MCAI (up 1.1 percent over the month) and Conforming MCAI (up 0.8 percent) saw upward mobility, while the Jumbo MCAI was unchanged over the month and the Government MCAI dropped by a slight 0.2 percent.

"Credit availability increased slightly in September due to some expansion of conventional affordable offerings," said MBA Chief Economist Mike Fratantoni. "In particular, this month there was an increase in the offerings of Freddie Mac's affordable lending programs."