Home Prices, Existing-Home Sales Continue Their Ascension

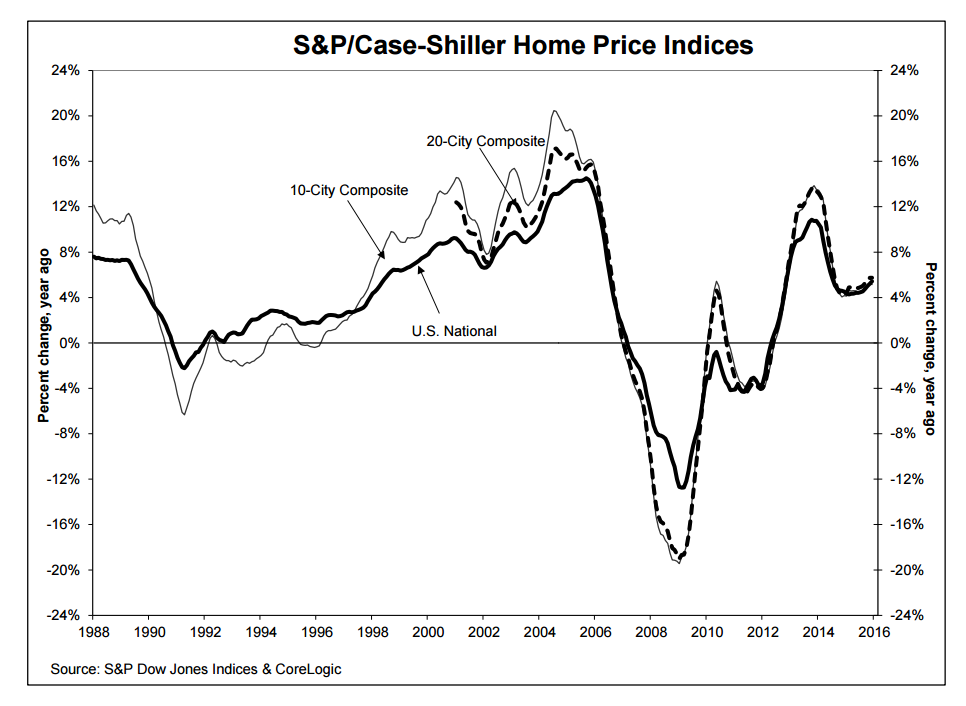

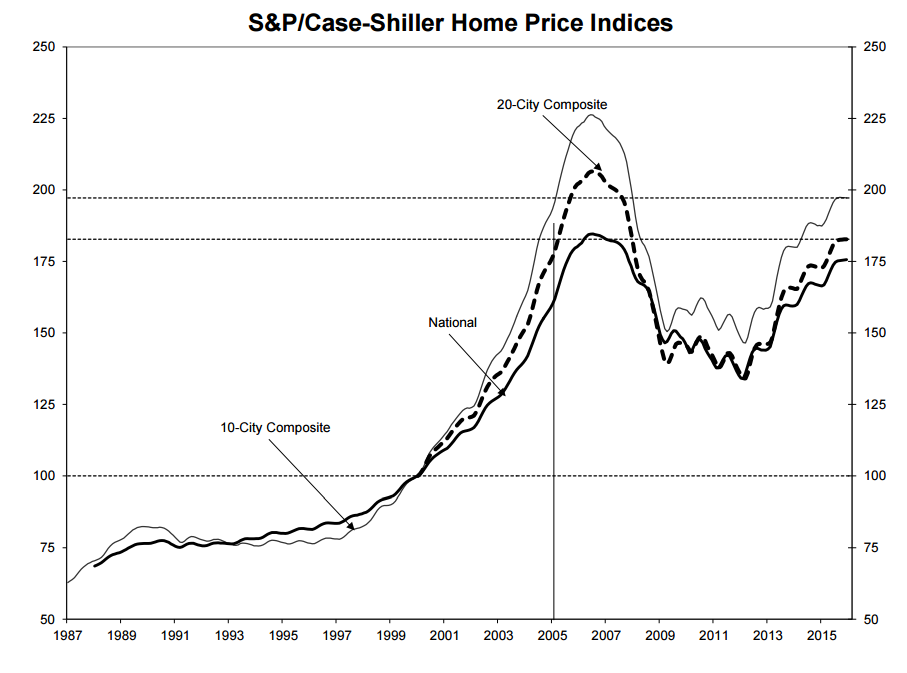

Home prices closed 2015 on the rise, according to the latest S&P/Case-Shiller Home Price Indices report.

The S&P/Case-Shiller U.S. National Home Price Index registered a 5.4 percent year-over-year gain in December 2015, up slightly from the previous month’s 5.2 percent. The 10-City Composite increased 5.1 percent in the year to December compared to 5.2 percent in November, while the 20-City Composite’s year-over-year gain remained unchanged month-by-month at 5.7 percent.

Prior to the seasonal adjustment, the both the National Index and the 10-City Composite posted 0.1 percent month-over-month upticks in December while the 20-City Composite remained unchanged in December. After the seasonal adjustment, the National and 20-City Composites Index both recorded a monthly increase of 0.8 percent and the 10-City Composite increased 0.7 percent month-over-month in December. Ten of 20 cities reported increases in December before the seasonal adjustment, while 19 cities increased for the month after the seasonal adjustment.

Portland registered the greatest year-over-year price increase at 11.4 percent, followed by San Francisco with 10.3 percent and Denver with 10.2 percent. The 6.3 percent increase in Phoenix in December marked that city’s twelfth consecutive increase in annual price gains.

However, David M. Blitzer, managing director and chairman of the Index Committee at S&P Dow Jones Indices, cautioned that the road to housing recovery may be facing a yellow light.

“While home prices continue to rise, the pace is slowing a bit,” Blitzer said. “Seasonally adjusted, Miami had lower prices this month than last and 10 other cities saw smaller increases than last month. Year-over-year, seven cities saw the rate of price increases wane. Even with some moderation, home prices in all but one city are rising faster than the 2.2 percent year-over-year increase in the CPI core rate of inflation.”

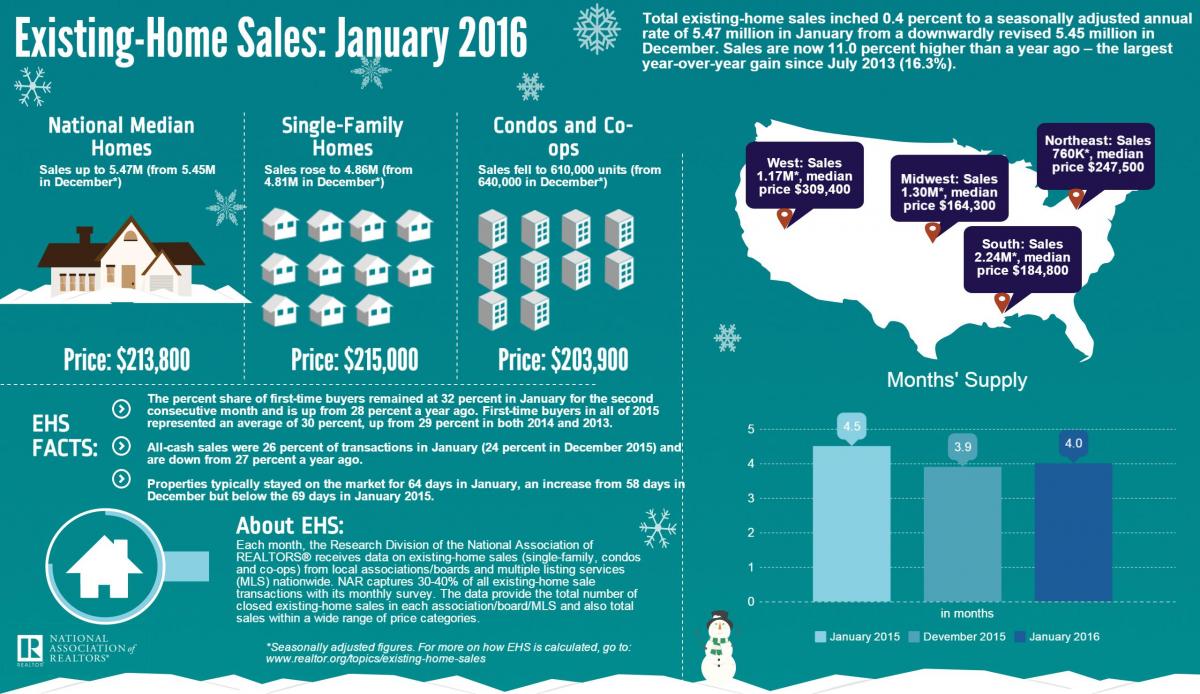

Separately, the National Association of Realtors (NAR) reported that total existing-home sales saw a minimal increase of 0.4 percent to a seasonally adjusted annual rate of 5.47 million in January from a downwardly revised 5.45 million in December. On a year-over-year measurement, however, sales are 11 percent above the January 2015 level.

NAR determined the median existing-home price for all housing types in January was $213,800, an 8.2 percent year-over-year spike and largest price increase since the 8.5 percent rise in April 2015. The total housing inventory at the end of January increased 3.4 percent to 1.82 million existing homes available for sale, down 2.2 percent from a year ago. The share of first-time buyers remained at 32 percent in January for the second consecutive month; it was 28 percent a year ago. First-time buyers in all of 2015 represented an average of 30 percent, up from 29 percent in both 2014 and 2013.

“The spring buying season is right around the corner and current supply levels aren’t even close to what’s needed to accommodate the subsequent growth in housing demand,” said NAR Chief Economist Lawrence Yun. “Home prices ascending near or above double-digit appreciation aren’t healthy–especially considering the fact that household income and wages are barely rising.”