Advertisement

30-Year Fixed Mortgage Rate at New 2017 Low

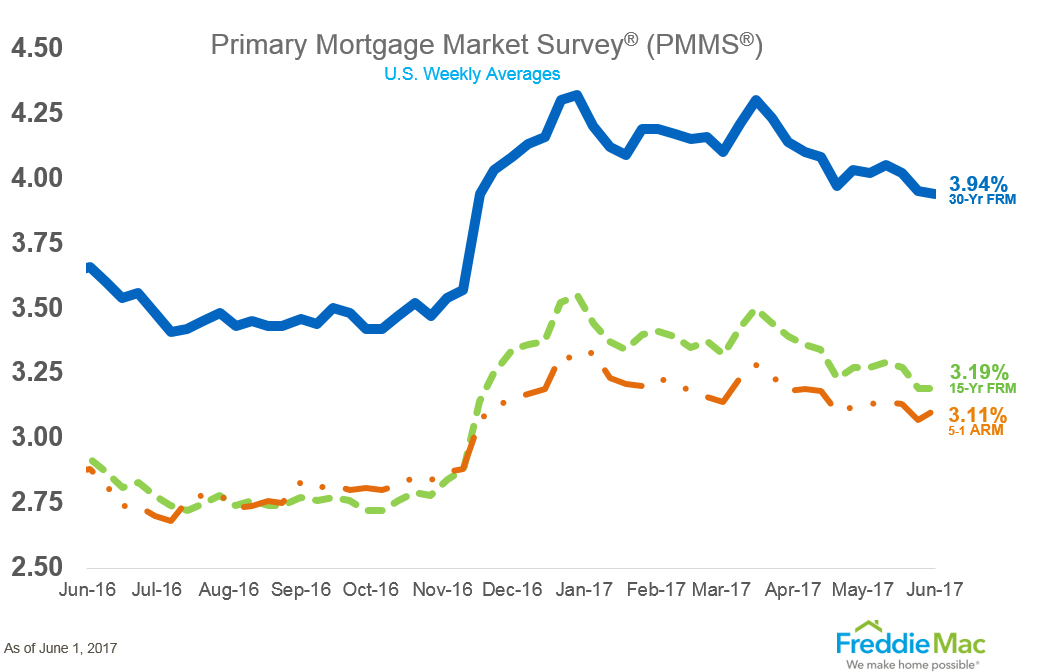

The 30-year fixed mortgage rate dropped for the third consecutive week and set a new low for the year, according to Freddie Mac’s Primary Mortgage Market Survey (PMMS).

The 30-year fixed-rate mortgage (FRM) averaged 3.94 percent for the week ending June 1, down from last week when it averaged 3.95 percent. Still, this level is higher than the same time in 2016, when the 30-year FRM averaged 3.66 percent.

However, the other rate news was not negative. The 15-year FRM this week averaged 3.19 percent, unchanged from last week. And the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.11 percent this week, up from last week when it averaged 3.07 percent.

About the author