CFPB Issues Warnings On Reverse Mortgage Marketing

Says it is working with state regulators to ensure fairness in advertising and teach consumers where to go for help.

The Consumer Protection Finance Bureau is out with a new report on reverse mortgage marketing. It expresses concerns that poorer senior consumers are being targeted by advertising.

The report said, “Nearly three-quarters (74%) of reverse mortgage direct mail advertising volume went to consumers with low and moderate incomes (household income below $75,000) in 2021-2022. This suggests direct mail advertising disproportionally targets low and moderate-income households since only 53% of households headed by an older homeowner have incomes below $75,000.”

In 2021, consumers received an estimated 44 million direct mail advertisements about reverse mortgages and 48 million ads in 2022. This estimated ad volume is about four times higher than in 2019 and 2020 when the volume was approximately 11 million each year. A small number of companies are responsible for most of the ad volume, with one company accounting for approximately two-thirds (66%) of estimated direct mail reverse mortgage advertising volume between 2016-2022. The CFPB did not identify the company.

The CFPB said its “findings reflect that recent reverse mortgage advertising, which experienced a four-fold increase since 2019, largely focused on older homeowners with high equity and lower incomes and those residing in regions where homeowners have somewhat less ability to stay current on their housing payments. Although the intent of the HECM program is to meet the needs of older adult homeowners with lower incomes, the data nevertheless suggests that reverse mortgage lenders are potentially targeting vulnerable populations with an expensive product that may not be best suited for their individual housing and financial needs.”

Reverse mortgages, also known as home equity conversion mortgages, are mostly sold by a small coterie of companies. The CFPB said in 2021, the top 10 reverse mortgage lenders accounted for about 93% of all reverse mortgage originations.

Those numbers have changed recently. According to Reverse Market Insight, which tracks reverse mortgage originations, the top 10 companies over the last 12 months (August 2022 to July 2023) accounted for 78% of the reverse mortgage originations. June 2023 was an active month for new lenders with three. There are slightly over 100 active HECM lenders.

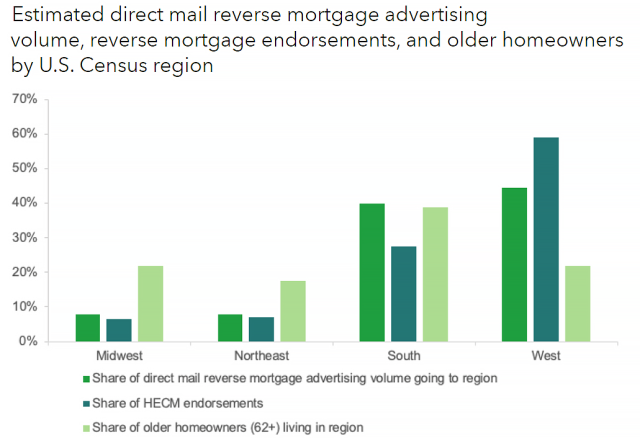

In certain parts of the country, seniors appear to be targeted more aggressively. The CFPB said, “Older homeowners in both the South and West display some unique characteristics that raise potential concerns about the financial circumstances of borrowers there. In both regions, a somewhat larger share of older homeowners report difficulty covering regular expenses. Additionally, a slightly larger share of older adults appears to be behind on their mortgages than older adults in the Midwest and Northeast. In the South region, older homeowners are more likely to have credit card and medical debt than older adults in the Northeast and Midwest regions. In the West region, older homeowners are more likely to own their homes with an outstanding mortgage than older homeowners in other regions.”