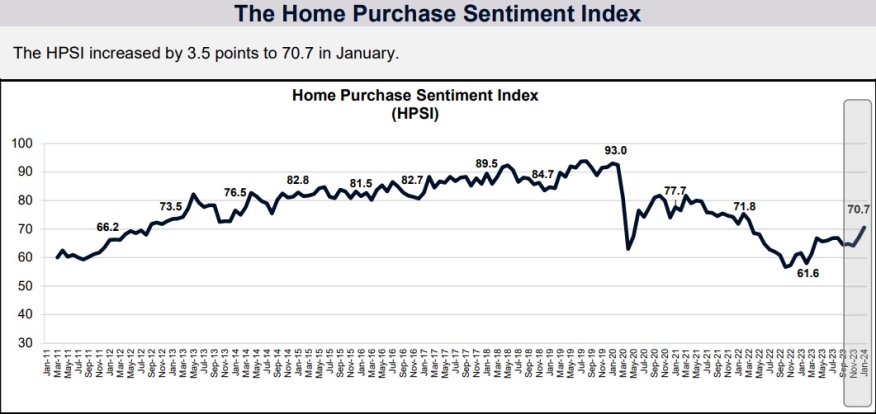

Fannie Mae Home Purchase Sentiment Index Climbs For Third Straight Month

Consumer confidence in selling homes rises, but buying sentiment remains pessimistic.

The Fannie Mae Home Purchase Sentiment Index found a steady upward trend, with the index increasing by 2.1 points in February to reach 72.8. This marks the third consecutive month of growth, primarily fueled by growing optimism surrounding home-selling conditions.

According to the report, a significant 65% of consumers surveyed in February stated that it is currently a good time to sell a home, up from 60% in the previous month. Conversely, sentiments regarding the desirability of buying a home saw a modest increase, but still remain notably pessimistic, with only 19% of consumers believing it's a good time to buy.

Despite concerns over rising mortgage rates, a plurality of consumers maintain an optimistic outlook, with many anticipating a decrease in mortgage rates over the next 12 months. Although this component of the index saw a slight decline this month, it remains relatively positive.

Doug Duncan, senior vice president and chief economist at Fannie Mae, noted the significance of the steady ascent, highlighting that consumer sentiment towards housing now surpasses levels seen at the same time last year. Duncan emphasized the increase in optimism among current homeowners regarding the timing of selling their homes, suggesting a potential uptick in existing home listings in the near future.

"Additionally, despite the recent uptick in rates, consumers remain relatively optimistic that mortgage rates will decrease over the next 12 months," Duncan said. "If their expectations come true and rates move closer to the six-percent mark by the end of 2024, as we currently expect, then it’s likely that consumer sentiment on both sides of the transaction will improve, perhaps leading to a further thawing of the housing market."

Looking ahead to the upcoming spring homebuying season, Duncan highlighted the potential positive implications of a decline in mortgage rates on buyer sentiment. However, he acknowledged that affordability remains a significant challenge for buyers, underscoring the need for a meaningful increase in net supply to address housing market dynamics.

The continued optimism reflected in the Fannie Mae HPSI underscores evolving consumer perceptions in the housing market, with potential implications for both buyers and sellers in the months ahead.