Homeownership Expenses Eat Away Affordability

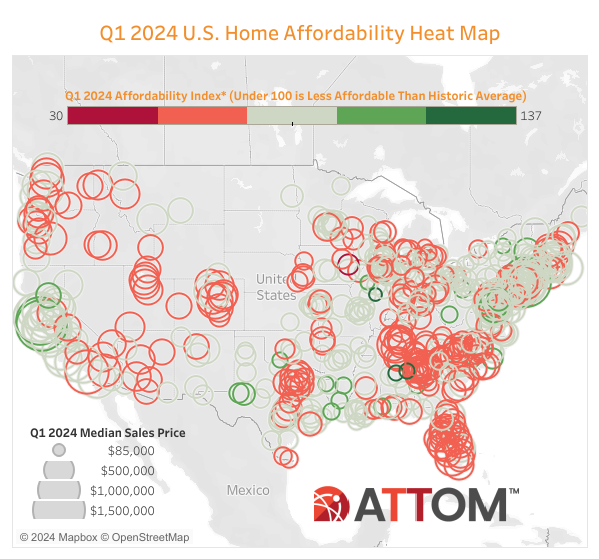

Of more than 500 counties analyzed by ATTOM, 97.8% are less affordable in the first quarter of 2024 than their historic averages.

- Nationwide, the typical $1,930 cost of mortgage payments, homeowner insurance, mortgage insurance, and property taxes consumes 32.3% of the average annual wage of $71,708.

- The top 20 counties where major ownership costs require the largest percentage of average local wages are located on the northeast and west coasts.

ATTOM's first-quarter 2024 U.S. Home Affordability Report, released Thursday, revealed that median-priced single-family homes and condos remain less affordable in the first quarter of 2024 compared to historical averages in more than 95% of counties nationwide with enough data to analyze.

The latest trend continues a pattern, dating back to 2022, of home ownership requiring historically larger portions of wages for income earners around the country. The report also shows that major expenses on median-priced homes consume 32.3% of the average national wage in the first quarter, several points above common lending guidelines.

Both measures represent slight quarterly improvements but remain worse than a year ago, still sitting at levels that have worked against home buyers for three years. That scenario has continued as increases in home values and major home-ownership expenses have outpaced gains in wages.

As a result, the portion of average wages nationwide spent on typical mortgage payments, property taxes, and insurance remains up almost three percentage points from a year ago and 11 points from early 2021, right before home mortgage rates began shooting up from their lowest levels in decades.

“The picture for home buyers is brightening a little again as affordability measures have improved for the second quarter in a row,” said Rob Barber, CEO of ATTOM. “For sure, it’s not like things are coming up roses for house hunters. Affording a home remains a financial stretch, or a pipe dream, for so many households. But with mortgage rates coming down and home prices growing only by modest amounts, it’s gotten a bit easier for average wage earners to afford a home so far this year. The upcoming Spring buying season will say a lot about whether home prices remain stable enough for this trend to continue.”

The first-quarter patterns come as the national median home price has risen less than 2% this quarter from the previous quarter, down from peaks hit last year. Inflation, while still running close to 4 percent, is less than half 2021 levels. Though those factors show alleviating homeownership expenses, other studies point to continual patterns of affordability concerns.

ATTOM’s report determined affordability for average wage earners by calculating the amount of income needed to meet major monthly homeownership expenses — including mortgage payments, property taxes, and insurance — on a median-priced single-family home, assuming a 20% down payment and a 28% maximum “front-end” debt-to-income ratio.

Compared to historical levels, median home ownership costs in 577 of the 590 counties analyzed (97.8%) in the first quarter of 2024 are less affordable than than their historic affordability averages. That number is down slightly from 584 of the same counties (99%) in the fourth quarter of last year, but up from 549 in the first quarter of last year (93.1%), and more than 10 times the number of counties (7.8%) less affordable than their historical average from early 2021.

The national median price for single-family homes and condos grew to $336,250 in the first quarter of 2024, just $9,000 less than the all-time high of $345,000 hit several times in the past two years. The latest figure is up 1.9% from $330,000 in the fourth quarter of 2023 and up 5.1% from $319,900 in the first quarter of last year.

Among the 46 counties in the report with a population of at least 1 million, the biggest year-over-year increases in median prices during the first quarter of 2024 are in Orange County, CA, up 14.6%, and Santa Clara County, CA, up 10.3%.

Average Wage Earners Suffer

With mortgage rates trending downward in recent months after rising last year, the portion of average local wages consumed by major expenses on median-priced, single-family homes and condos has decreased from the fourth of 2023 to the first quarter of 2024 in 91.5% of the 590 counties analyzed. However, it remains up annually in 90.3% of those markets.

The typical $1,930 cost of mortgage payments, homeowner insurance, mortgage insurance, and property taxes nationwide consumes 32.3% of the average annual national wage of $71,708 this quarter. That is down from 33.2% in the fourth quarter of 2023 as expenses commonly have dropped almost 3% while wages have remained flat nationwide.

The latest portion is up from 29.6% in the first quarter of last year and is far above the recent low point of 21.3% hit in the first quarter of 2021 as wage gains have lagged behind increases in expenses over that longer period.

The report noted that homeownership on the northeast and west coasts still eats up the largest chunk of wages. The top 20 counties where major ownership costs require the largest percentage of average local wages are located on either coast, the leaders being Kings County (Brooklyn), NY with 109.5% of annualized local wages needed to buy a single-family home; Marin County, CA (102.8%); and, Maui County, HI (100.5%).