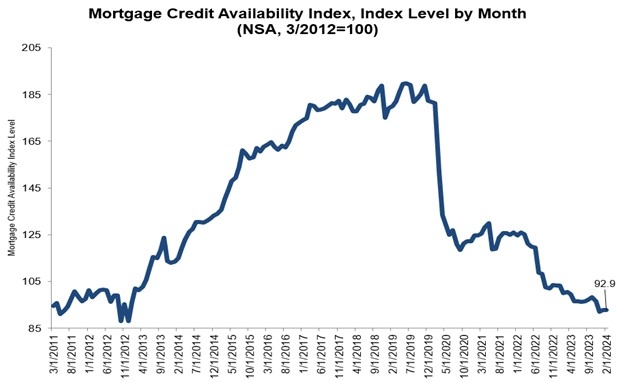

Mortgage Credit Availability Sees Slight Uptick In February, But Market Remains Tight

The Mortgage Credit Availability Index sees modest increase, reaching 92.9; conventional loans expand slightly, while government programs remain stable.

The Mortgage Bankers Association says it saw a slight uptick in mortgage credit availability in February, but the mortgage credit market is still tight.

The Mortgage Credit Availability Index rose 0.2% to reach 92.9.

A decline in the MCAI typically suggests tightening lending standards, while increases in the index reflect a trend towards more lenient credit conditions. The index is benchmarked to 100 in March 2012.

The Conventional MCAI recorded an increase of 0.5%, indicating expanded credit availability within non-government loan programs. Conversely, the Government MCAI remained largely unchanged. Among the component indices of the Conventional MCAI, the Jumbo MCAI saw a marginal increase of 0.1%, while the Conforming MCAI experienced a more substantial rise of 1.6%.

“Mortgage credit availability remains quite tight – near the lowest levels in MBA’s survey – even as application volume lags last year’s pace and as the industry continues to reduce capacity. Despite these factors, credit criteria remain conservative,” MBA Deputy Chief Economist Joel Kan said. “There was a slight increase in credit availability for refinance loan programs last month. The purchase market, however, continues to be impacted by supply and affordability constraints, due to higher mortgage rates.”

The MCAI's incremental rise underscores the delicate balance between risk management and expanding access to credit in the mortgage market. As lenders navigate changing economic conditions and evolving borrower needs, the index serves as a tool for assessing credit risk and availability.