U.S. Non-Bank Mortgage Lenders Surge Amid Industry Consolidation, Fitch Ratings Reports

As smaller players exit the market, scaled originators like UWM and PennyMac Financial dominate, but challenges persist with low origination volume and pressured margins amidst rising interest rates.

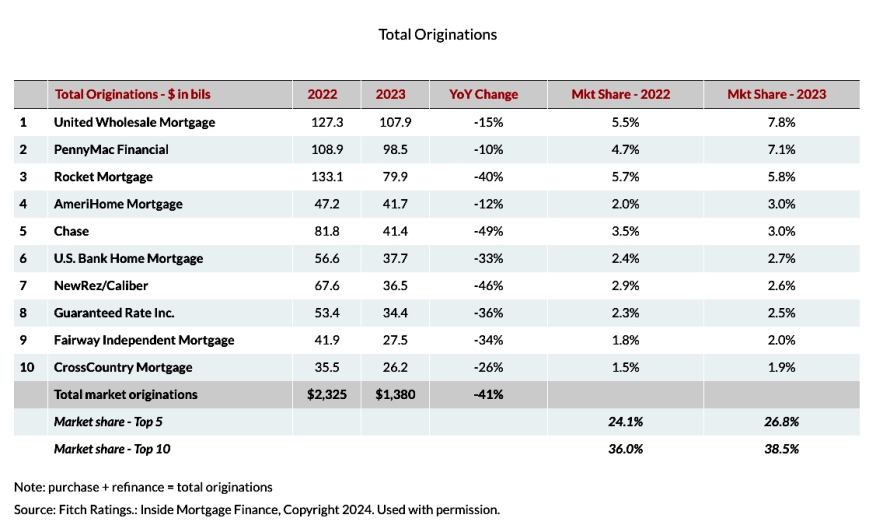

As first reported by NMP in December, amidst a backdrop of consolidation and exits by smaller players in the non-bank mortgage lending industry, Fitch Ratings says the largest U.S. non-bank mortgage lenders continue to strengthen their market share. The reduction in industry capacity, fueled by a challenging environment of low origination volume and pressured gain-on-sale margins, has led to an exodus of sub-scale originators. Employment in the non-bank mortgage industry has fallen by 35% compared to peak levels in 2021, according to the Bureau of Labor Statistics.

"Continued consolidation will further benefit the largest originators, which have strengthened their franchises and will be able to take advantage of their competitive positions once origination volumes resume," the rating agency's researchers wrote.

Scaled lenders, equipped with strong franchises and cost-saving initiatives, have weathered the storm more effectively.

"UWM was responsible for 48% of wholesale-broker originations in 2023, up from 37% in 2022, and over four times the volume of Rocket Mortgage, the second largest player with 12% market share, per Inside Mortgage Finance. PFSI had 22% of correspondent channel volume, up from 15% share in 2022, and double that of AmeriHome Mortgage, the second largest correspondent originator with 10% market share," according to the ratings agency.

Despite the challenging operating environment expected to persist through 2024, lenders with leading market positions are anticipated to continue gaining share, supported by scalable technology platforms and access to liquidity. Mortgage rates, forecasted to remain between 6.5%-7.5% in 2024, are expected to see only modest declines, maintaining pressure on profitability. However, right-sized cost structures and reduced borrowing are expected to mitigate these challenges, ensuring financial performance remains within ratings sensitivities.

The significant reduction in mortgage originations, which fell 48% year-over-year in 2022 and an additional 41% in 2023, underscores the profound impact of rising interest rates and dwindling housing inventory on the industry. For 2023, refinance and purchase originations were down 73% and 20% year over year respectively. Retail originations are down the most from 2021 origination highs (-72%), followed by broker (-68%) and correspondent (-62%) channels.

"Our deteriorating sector outlook for non-bank mortgage companies is based on the expectation for persistently high interest rates and our expectation for a slowing economy," the rating agency said. "However, we expect financial performance to remain within ratings sensitivities amid meaningful cost reductions and reduced warehouse borrowing."