Advertisement

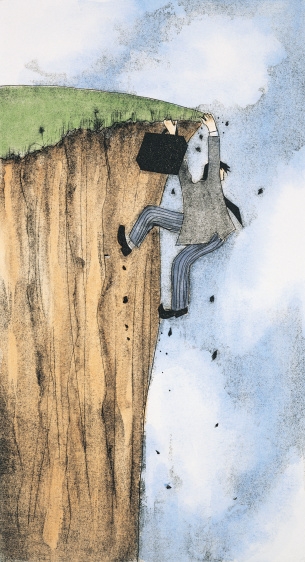

Keeping Your Edge in 2012

I've written previously on how by the time the holidays are here, the year has already ended. It's the time to spend time with family, friends and those business relationships we really appreciate. But, it can also be a time for reflection, goal-setting and planning for the new year.

The year 2012 is going to be a great challenge for many of us. Lending guidelines are changing faster than ever, while foreclosures and short sales aren't going away any time soon. The following areas are two of the biggest challenges originators can face next year. By being prepared, you can turn these adversities into opportunities while others continue to struggle.

Dealing with changing guidelines

There's often a significant period of time between when a borrower gets pre-qualified and when they actually apply. Since guidelines are changing frequently, originators often find themselves getting contacted by those who were pre-qualified weeks or months ago, and being forced to tell their would-be borrowers that the pre-qualification is no longer valid. This can lead to mistrust between the borrower and originator and a setback to the borrower who may have been ready to move on a real estate transaction.

By diligently keeping in touch with borrowers whom you pre-qualified, you can inform them of these guideline changes on your terms, rather than reacting to them when the borrower comes back to you. With this strategy, the perception changes from mistrust and frustration, to a mortgage professional who is staying on top of their pipeline. The borrowers will appreciate your initiative.

Educating your referral network

In addition to your problems, real estate agents in your referral network will have their own set of challenges to deal with, particularly when it comes to short sales. If it's their problem, then it's your problem too.

Stay one step ahead of the changing short sale and real estate landscape. Don't expect real estate agents to know what they have to know to close a short sale smoothly. If you can educate your agents on how to easily close a short sale, they can close more business; leading to more originations for you.

Victor Pascale of Continental Home Loans spends considerable time to educate his real estate agents on the short sale process.

"I can only imagine how much commissioned real estate agents would have lost if I wasn't there to help them with their short sales," said Pascale.

Victor gets his real estate agents the education and tools they need to make short sales just another transaction.

While it's never bad to be proactive, 2012 will be a year where taking the initiative to educate your referral network and provide them with resources to make more money will pay dividends throughout the year.

Erik Wind is co-founder of ShortSaleSpeedway. He may be reached by phone at (516) 882-6930 or e-mail at [email protected].

About the author