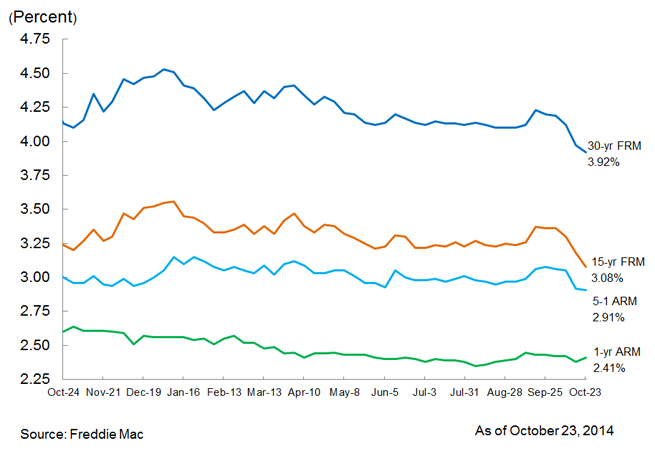

Fixed-Rates Drop to 18-Month Low

Freddie Mac has released the results of its weekly Primary Mortgage Market Survey (PMMS), showing average fixed mortgage rates hitting fresh lows for the year for the second consecutive week amid declining bond yields. The 30-year fixed-rate mortgage (FRM) averaged 3.92 percent with an average 0.5 point for the week ending Oct. 23, 2014, down from last week when it averaged 3.97 percent. A year ago at this time, the 30-year FRM averaged 4.13 percent. The 15-year FRM this week averaged 3.08 percent with an average 0.5 point, down from last week when it averaged 3.18 percent. A year ago at this time, the 15-year FRM averaged 3.24 percent.

"Fixed mortgage rates continued to fall this week after the yield on 10-year Treasuries dropped to their lowest point of the year," said Frank Nothaft, vice president and chief economist, Freddie Mac. "Existing home sales beat expectations in September clocking in at an annual rate of 5.17 million units, up 2.4 percent from August. Housing starts were up 6.3 percent in September adding a seasonally adjusted annual rate of 1.017 million units. Building permits rose 1.5 percent to a seasonally adjusted annual rate of 1.018 million units in September."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.91 percent this week with an average 0.5 point, down from last week when it averaged 2.92 percent. A year ago, the five-year ARM averaged three percent. The one-year Treasury-indexed ARM averaged 2.41 percent this week with an average 0.4 point, up from last week when it averaged 2.38 percent. At this time last year, the one-year ARM averaged 2.60 percent.