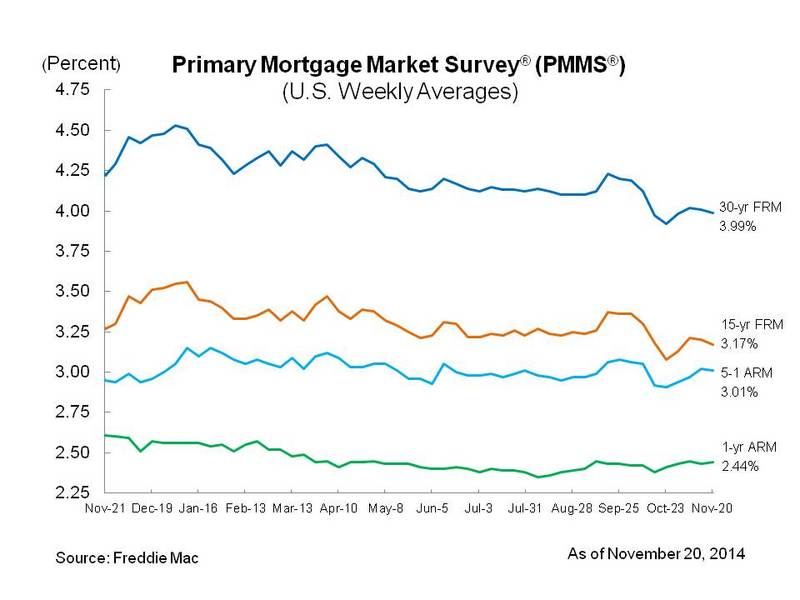

Mortgage Rates Decline and Head Below the Four Percent Mark

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing average fixed-rate mortgages (FRMs) slightly down from the previous week with the 30-year FRM dipping just below four percent to 3.99 percent, with an average 0.5 point for the week ending Nov. 20, 2014. This total was down from last week when it averaged 4.01 percent. A year ago at this time, the 30-year FRM averaged 4.22 percent. The 15-year FRM this week averaged 3.17 percent with an average 0.5 point, down from last week when it averaged 3.20 percent. A year ago at this time, the 15-year FRM averaged 3.27 percent.

"Fixed mortgage rates were slightly down as housing starts declined 2.8 percent in October below the upwardly revised September rate," said Frank Nothaft, vice president and chief economist, Freddie Mac. "However, building permits increased 4.8 percent in October after a 2.8 percent boost a month earlier. Lastly, industrial production slipped by 0.1 percent in October, below the market consensus forecast."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.01 percent this week with an average 0.5 point, down from last week when it averaged 3.02 percent. A year ago, the five-year ARM averaged 2.95 percent. The one-year Treasury-indexed ARM averaged 2.44 percent this week with an average 0.4 point, up from last week when it averaged 2.43 percent. At this time last year, the one-year ARM averaged 2.61 percent.