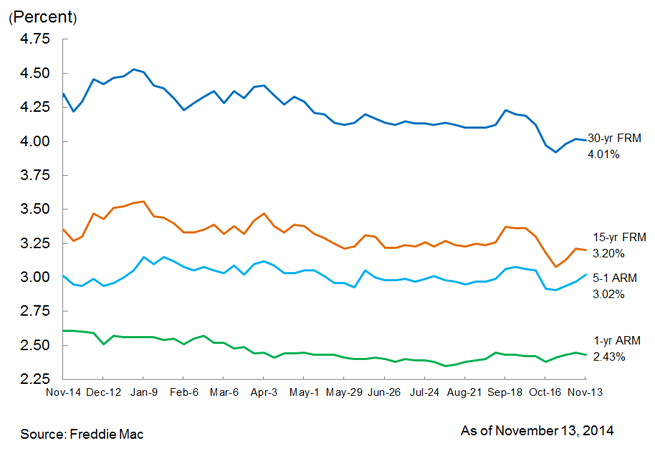

Fixed-Rates Level Off, Remain in the Four Percent Range

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing average fixed mortgage rates little changed from the previous week with the 30-year mortgage still hovering around four percent. The 30-year fixed-rate mortgage (FRM) averaged 4.01 percent with an average 0.5 point for the week ending Nov. 13, 2014, down from last week when it averaged 4.02 percent. A year ago at this time, the 30-year FRM averaged 4.35 percent. The 15-year FRM this week averaged 3.20 percent with an average 0.5 point, down from last week when it averaged 3.21 percent. A year ago at this time, the 15-year FRM averaged 3.35 percent.

"Fixed mortgage rates were slightly down on mixed results from October's employment report," said Frank Nothaft, vice president and chief economist, Freddie Mac. "While the unemployment rate declined to 5.8 percent, nonfarm employment rose by 214,000 jobs, which was below consensus expectations. Net revisions for payroll employment in August and September added 31,000 more jobs to the initial readings."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.02 percent this week with an average 0.5 point, up from last week when it averaged 2.97 percent. A year ago, the five-year ARM averaged 3.01 percent. The one-year Treasury-indexed ARM averaged 2.43 percent this week with an average 0.4 point, down from last week when it averaged 2.45 percent. At this time last year, the one-year ARM averaged 2.61 percent.