Trade Groups Call Out CFPB on Message Confusion

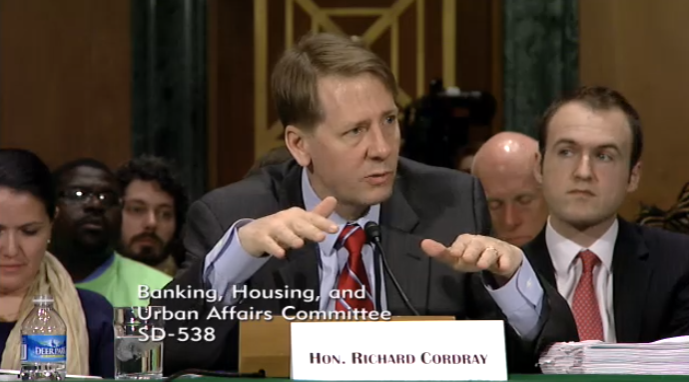

Three leading financial services trade associations have openly questioned the Consumer Financial Protection Bureau’s (CFPB) regulatory efforts.

At a hearing yesterday before the Senate Banking Committee, Mortgage Bankers Association (MBA) Senior Vice President of Legislative and Political Affairs Bill Killmer urged the CFPB to provide clear "rules of the road" whenever it plans to create new rules or to update both existing guidelines and the interpretations of longstanding policies. Killmer also repeated an oft-stated industry concern regarding the CFPB’s eagerness to aggressive enforce its will.

"Five years after the enactment of Dodd-Frank, enforcement actions present very significant challenges to the residential mortgage industry," Killmer said. "Unfortunately, the CFPB has recently appeared to take a 'regulation by enforcement' approach, offering industry participants little guidance and simply instituting claims against them—often using new interpretations of old rules … Unfortunately, despite lenders' good-faith efforts to comply with the CFPB's rules—including using compliance management systems, seeking advice from outside counsel and seeking clarity directly from the CFPB—ambiguities remain and answers, even among CFPB employees, are inconsistent. Oral guidance, whether provided privately in response to individual inquiries or on CFPB's webinars, does not address the need for authoritative written guidance issued broadly to industry."

Killmer also cited the implementation of the TRID rule last fall as an example of a communications malfunction by the CFPB.

"At its core, TRID represents the largest restructuring of the residential mortgage application-to-closing process in nearly 40 years," Killmer said. "Implementing this new rule required major changes to industry systems and business processes as well as thousands of hours of training. In light of this complexity, the CFPB announced prior to the Oct. 3 effective date that it would take into account 'good faith efforts' by industry to comply with the rule. Unfortunately, the CFPB did not provide a timeline for this good faith window, nor did it define the scope of good faith compliance."

Separately, Richard Hunt, president of Consumer Bankers Association, used a speech before a banking trade publication conference to deride the agency’s consumer complaint database as being “not even a better version of Yelp,” adding that the information provided is not verified before being made public.

“When we think the CFPB is wrong, we go after them,” said Hunt, according to coverage of his presentation from Auto Finance News. “When we think they are right, we give them credit. And I think the CFPB is dead wrong about their portal system.”

Speaking at the same conference, Camden Fine, president and CEO of the Independent Community Bankers Association (ICBA), shared Hunt’s concerns.

“More concerning is that they misuse the statistics from the portal,” he said. “They are not transparent, and we don’t know how they are slicing and dicing that data. In fact, they can say anything they want about a bank, depending on how they ‘cook the books,’ so to say.”