Luxury Home Prices Hit Highest Third-Quarter Level Ever

Redfin report says the market segment might soon cool, though.

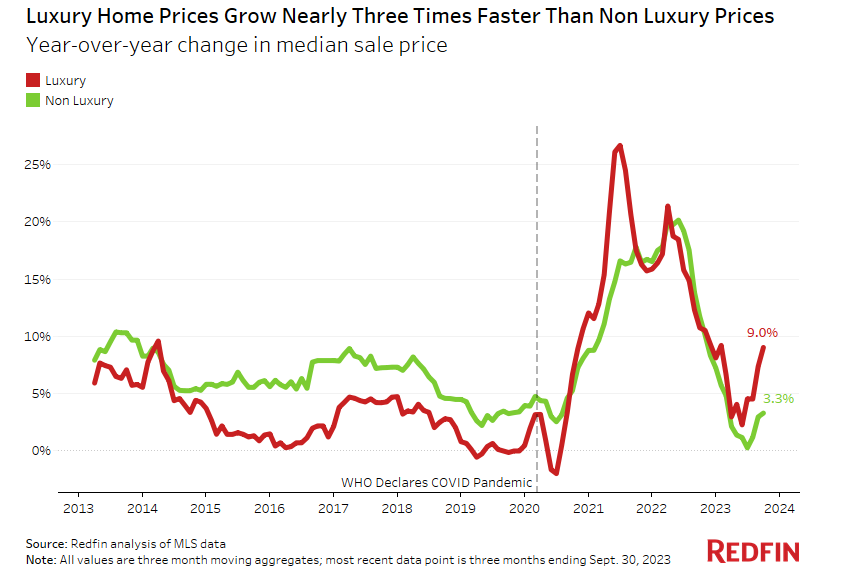

The affluent know how to combat high mortgage rates. They simply pay cash. That’s why a new report from Redfin shows luxury home prices rose 9% to the highest third-quarter level on record.

The median sale price of luxury U.S. homes rose 9% year over year to $1.1 million in the third quarter, while the median sale price of non-luxury homes climbed 3.3% to $340,000. Both were at the highest level of any third quarter on record, according to Redfin, the technology-powered real estate brokerage.

More than two in five (42.5%) luxury homes that sold in the third quarter were purchased in cash, up from just over one-third (34.6%) a year earlier. By comparison, just 28% of non-luxury homes that sold were bought in cash, little changed from the third quarter of 2022.

However, the luxury gravy train may not persist much longer. “While many luxury buyers have the resources to forge ahead even when mortgage rates are elevated, stubbornly high rates and home prices will likely push some affluent house hunters to the sidelines in the coming months,” said Redfin Chief Economist Daryl Fairweather. “High costs, along with the uptick in the number of high-end homes for sale, could cause luxury price growth to cool."

The total supply of luxury homes for sale (active listings) grew 2.9% from a year earlier in the third quarter, compared with a record 20.8% decline in the supply of non-luxury homes.

Similarly, new luxury listings rose 0.3%, still below pre-pandemic levels, while new, non-luxury listings fell 22% to stand at the the lowest third-quarter level since 2012.

One reason luxury listings have held up relatively well is that high-end homeowners are less likely to feel locked into their low mortgage rate, either because they don’t have a mortgage at all or because they have the means to move and take on a higher rate.

“Wealthy homebuyers have more tools to weather the storm of high mortgage rates,” said Redfin Senior Vice President of Real Estate Operations Jason Aleem. “Many of them can afford to pay in cash, meaning they’re escaping high mortgage rates altogether. Others are choosing to take on a higher rate and refinance later—an expensive option that isn’t feasible for a lot of lower-income consumers. Affluent Americans are still spending big, in large part because of pandemic savings and resilient housing and stock values.”

Another reason luxury listings are outperforming is an increase in homebuilding. Newly built homes tend to be more expensive, meaning they often fall into the luxury tier.