Slip-Sliding Away: Mortgage Credit Availability Falls For 3rd Straight Month

Mortgage Credit Availability Drops Again, Leaving Borrowers High and Dry

Mortgage credit availability decreased in May for the third straight month, the Mortgage Bankers Association said Tuesday.

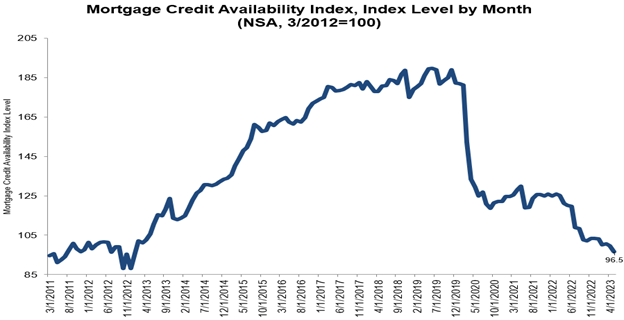

According to the MBA’s Mortgage Credit Availability Index (MCAI), a report that analyzes data from ICE Mortgage Technology, the index fell by 3.1% to 96.5 in May.

A decline in the MCAI indicates that lending standards are tightening, while an increase indicates loosening credit. The index was benchmarked to 100 in March 2012.

The Conventional MCAI decreased 2.3%, while the Government MCAI decreased by 3.8%. Of the component indices of the Conventional MCAI, the Jumbo MCAI decreased by 1.5%, and the Conforming MCAI fell by 3.9%.

“Mortgage credit availability decreased for the third consecutive month, as the industry continued to see more consolidation and reduced capacity as a result of the tougher market,” said Joel Kan, MBA’s vice president and deputy chief economist.

“With this decline in availability, the MCAI is now at its lowest level since January 2013,” Kan said. “The Conforming index decreased almost 4% to its lowest level in the history of the survey, which dates back to 2011.”

He said the decline in the Jumbo index fell was its first contraction in three months, “as some depositories assess the impact of recent deposit outflows and reduce their appetite for jumbo loans.”

“Additionally,” he said. “lenders pulled back on loan offerings for higher LTV and lower credit score loans, even as loan applications continued to run well behind last year’s pace. Both Conventional and Government indices saw declines last month, and the Government index fell by 3.8% to the lowest level since January 2013. In a market where a significant share of demand is expected to come from first-time homebuyers, the depressed supply of government credit is particularly significant.”