Total Household Debt Topped $17T In Q1 2023

N.Y. Fed says quarterly increase of 0.9% due mostly to non-housing-related debt.

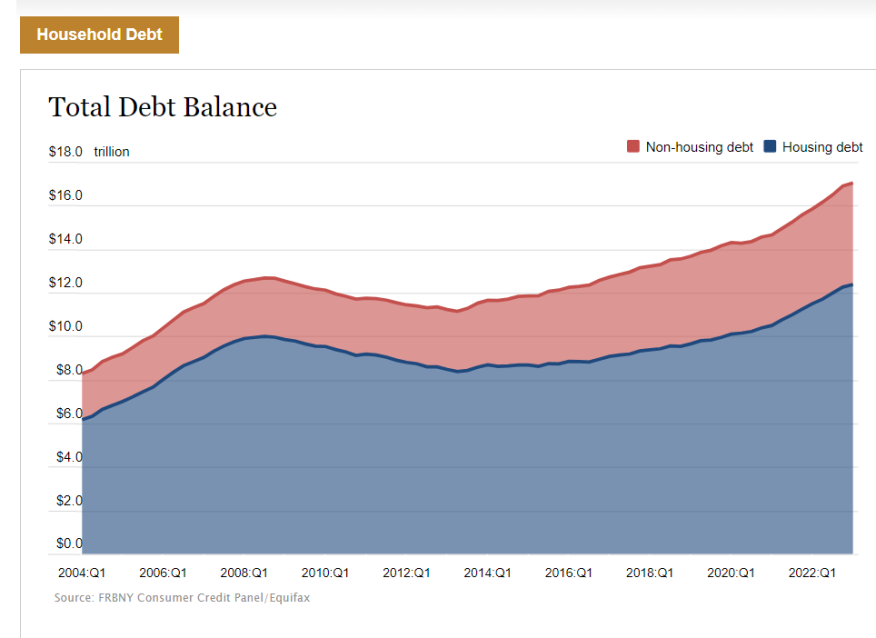

- Household debt totaled $17.05T in Q1, up $1.2T from a year earlier.

- Mortgage balances rose $121B in the quarter to $12.04T.

Household debt in the first quarter of this year topped $17 trillion, up more than $1.2 trillion from a year earlier, primarily due to the growth in non-housing-related debt.

The figures are the latest from the Federal Reserve Bank of New York, which on Monday released its Quarterly Report on Household Debt and Credit. The report found that overall household debt balances rose by $148 billion, or 0.9%, from the fourth quarter of last year to $17.05 trillion in the first quarter of 2023.

Household debt is now $2.9 trillion higher than it was at the end of 2019, before the recession caused by the COVID-19 pandemic.

The report is based on data from the New York Fed’s nationally representative Consumer Credit Panel.

Mortgage balances in the quarter rose modestly by $121 billion, and stood at $12.04 trillion at the end of March. Credit card balances, meanwhile, were flat in the quarter, holding at $986 billion.

Other balances increased:

- Auto loan balances in the first quarter rose by $10 billion from the previous quarter, bucking the typical trend of first-quarter declines.

- Student loan balances slightly increased and now stand at $1.6 trillion.

- Other balances, which include retail cards and other consumer loans, increased by $5 billion.

In total, non-housing balances grew by $24 billion, the report said.

Mortgage originations, which include both purchase loans and refinances, dropped sharply in the first quarter to $324 billion, the lowest level seen since 2014, the report said. In addition, new foreclosures remained low, with about 35,000 individuals having new foreclosure notations on their credit reports, roughly similar with levels in the previous quarter.

The volume of newly originated auto loans totaled $162 billion, also down from pandemic-era highs but still higher when compared to pre-pandemic volumes, the New York Fed said.

Aggregate limits on credit card accounts increased by $119 billion in the first quarter, a 2.7% increase from the previous quarter. Limits on home equity lines of credit increased by $9 billion in the first quarter, the report said.

The share of current debt becoming delinquent increased for most debt types. The delinquency transition rate for credit cards and auto loans increased by 0.6 and 0.2 percentage points, respectively approaching or surpassing their pre-pandemic levels.

Outstanding student loan debt totaled $1.6 trillion in the first quarter, with less than 1% of aggregate student debt 90 or more days delinquent or in default in the quarter, a small decline from the previous quarter. Student loan delinquency rates in the fourth quarter fell substantially due to the implementation of the Fresh Start program, which made previously defaulted loan balances current, the Fed said.

In addition to its quarterly report on debt and credit, the New York Fed also issued an accompanying Liberty Street Economics blog post taking a closer look at housing equity and mortgage refinancing as tools for funding consumer spending.

According to the blog post, 14 million mortgages were refinanced during the pandemic refinancing boom, during which $430 billion of home equity was extracted through cash-out refinances. About 64% of those mortgages were rate refinances, resulting in an average payment reduction of $220 monthly for those borrowers, the Fed said.

“The mortgage refinancing boom is over, but its impact will be seen for decades to come,” said Andrew Haughwout, director of household and public policy research for the New York Fed. “As a result of significant equity drawdowns, mortgage borrowers reduced their annual payments by tens of billions of dollars, providing additional funding for spending or paydowns in other debt categories.”