1 In Every 10 Homes Was Impacted By Natural Disasters In 2021

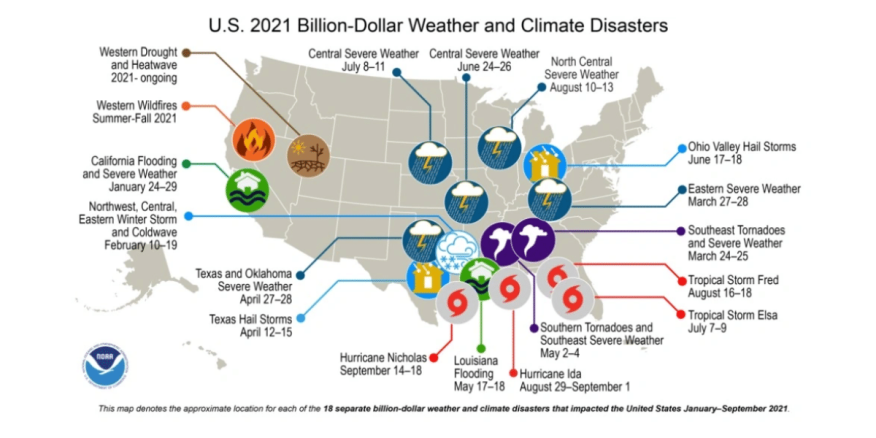

This year’s report studied 13 major hazard events that occurred in 2021, including hurricanes, tornados, hailstorms, wildfires, and even winter storms.

- 14.5 million single and multifamily homes were impacted by the largest natural disaster events of 2021 — about 1 in every 10 homes.

- Natural disasters are increasing in frequency and severity, impacting regions that are vulnerable and unprepared for economic disruptions.

- Houma, Louisiana: at the time of the hurricane's impact, delinquency rates hovered around 7.4% and the following month that rate nearly doubled to 13.3%.

- The climate change report calls on insurers, mortgage and financial professionals to educate themselves on the devastating effects of these events.

The 2021 CoreLogic Climate Change Catastrophe Report found that 14.5 million single and multifamily homes were impacted by the largest natural disaster events of 2021 — about 1 in every 10 homes — with an estimated $56.92 billion in property damage.

This year’s report studied 13 major hazard events that occurred in 2021, including hurricanes, tornados, hailstorms, wildfires, and even winter storms. Using advanced risk modeling technology, CoreLogic is able to analyze over 120 million residential structures in the United States and take a closer look at the defining impact. Different natural disasters can have varying impacts on property. A wildfire has the potential to consume an entire property, and leave damage by smoke, ash, and odor to neighboring structures. Any sort of property damage can have a compounding effect on the homeowner and their economic stability.

“By leveraging granular data for the increasing frequency and severity of catastrophes, we are able to see that more than 14.5 million homes were impacted to some degree by natural hazards in 2021. That’s about 1 in every 10 homes in the United States,” said Tom Larsen, CoreLogic’s principal, Industry Solutions. “Insurers and lenders can leverage the latest technologies and work cross-functionally to better understand this risk, protect homeowners and enable faster recovery times.”

Natural disasters are increasing in frequency and severity, impacting regions that are vulnerable and unprepared for economic disruptions. Job displacement and the destruction of real estate assets can certainly spell financial ruin, especially in communities where people are often unable to pay their mortgage, nevermind afford reconstruction costs.

Houma, Louisiana, was analyzed in the CoreLogic report as it had been hit head-on by Hurricane Ida in August 2021, a category 4 hurricane. At the time of impact, delinquency rates hovered around 7.4% and the following month that rate nearly doubled to 13.3% and hit 13.5% in October.

The climate change report calls on insurers, mortgage and financial professionals to educate themselves on the devastating effects of these events. The report urges them to harness technology and better anticipate the potential severity of natural disasters. What little you can do in the way of preparedness would be meaningful for protecting homeownership, insurer portfolios, and shielding the housing stock from collapse.