Home Prices in August Rose by 6.4 Percent Year-Over-Year

CoreLogic has released its August CoreLogic Home Price Index (HPI) report. Home prices nationwide, including distressed sales, increased 6.4 percent in August 2014 compared to August 2013. This change represents 30 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased 0.3 percent in August 2014 compared to July 2014.

At the state level, including distressed sales, all states showed year-over-year home price appreciation in August. The HPI reached new highs in a total of nine states, plus the District of Columbia. These states are Alaska, Colorado, Iowa, Louisiana, Nebraska, North Dakota, Oklahoma, Texas and Wyoming.

Excluding distressed sales, home prices nationally increased 5.9 percent in August 2014 compared to August 2013 and 0.3 percent month over month compared to July 2014. Also excluding distressed sales, 49 states and the District of Columbia showed year-over-year home price appreciation in August, with Mississippi being the only state to experience a year-over-year decline (-1.7 percent). Distressed sales include short sales and real estate-owned (REO) transactions.

The CoreLogic HPI Forecast indicates that home prices, including distressed sales, are projected to increase 0.2 percent month over month from August 2014 to September 2014 and, on a year-over-year basis, by 5.2 percent from August 2014 to August 2015. Excluding distressed sales, home prices are expected to rise 0.2 percent month over month from August 2014 to September 2014 and by 4.7 percent year-over-year from August 2014 to August 2015. The CoreLogic HPI Forecast is a monthly projection of home prices built using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“The pace of year-over-year appreciation continues to slow down as real estate markets find more balance. Home price appreciation reached a peak of almost 12 percent year-over-year in October 2013 and has since subsided to the current pace of 6 percent,” said Mark Fleming, chief economist at CoreLogic. “Continued moderation of home price appreciation is a welcomed sign of more balanced real estate markets and less pressure on affordability for potential home buyers in the near future.”

“Home prices continue to rise, albeit more slowly, across most of the U.S.,” said Anand Nallathambi, president and CEO of CoreLogic. “Major metropolitan areas such as Riverside and Los Angeles, California, and Houston continue to lead the way with strong price gains buoyed by tight supplies and a gradual rebound in economic activity.”

Highlights as of August 2014:

►Including distressed sales, the five states with the highest home price appreciation were: Michigan (+11.1 percent), California (+9.2 percent), Nevada (+9.2 percent), Maine (+9 percent) and West Virginia (+8.7 percent).

►Excluding distressed sales, the five states with the highest home price appreciation were: Massachusetts (+9.4 percent), Maine (+9.3 percent), West Virginia (+8.9 percent), Hawaii (+8.7 percent) and South Carolina (+8.1 percent).

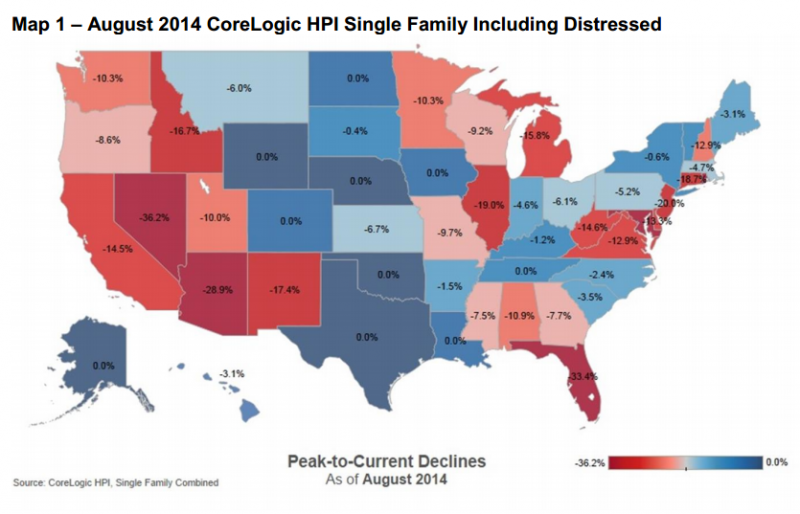

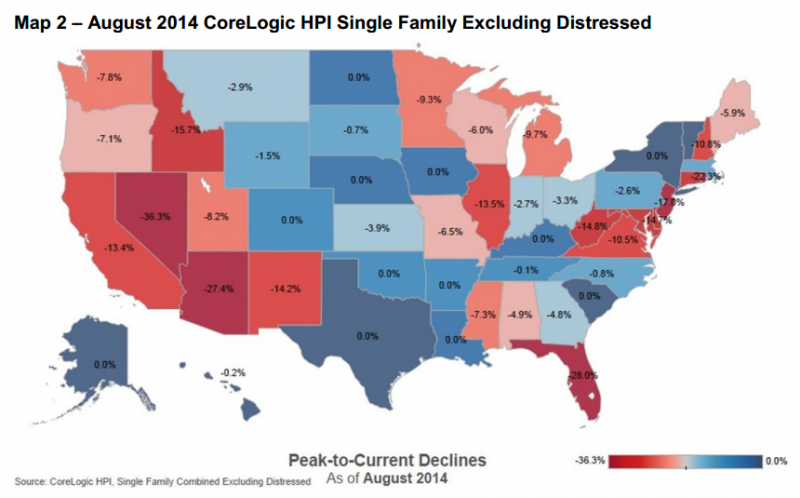

►Including distressed transactions, the peak-to-current change in the national HPI (from April 2006 to August 2014) was -12.1 percent. Excluding distressed transactions, the peak-to-current change in the HPI for the same period was -8.6 percent.

►The five states with the largest peak-to-current declines, including distressed transactions, were: Nevada (-36.2 percent), Florida (-33.4 percent), Arizona (-28.9 percent), Rhode Island (-26.8 percent) and Maryland (-20.2 percent).

►Including distressed sales, the U.S. has experienced 30 consecutive months of year-over-year increases; however, the national average is no longer posting double-digit increases.

►Ninety-eight of the top 100 Core Based Statistical Areas (CBSAs) measured by population showed year-over-year increases in August 2014. The two CBSAs that did not show an increase were Rochester, N.Y. and Little Rock-North Little Rock-Conway, Ark.