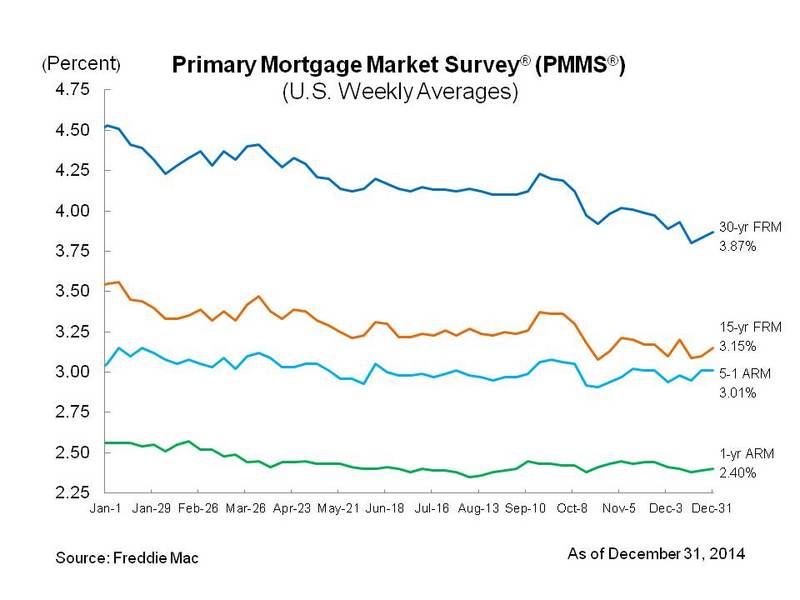

Fixed Rates Close Out 2014 Below the Four Percent Mark

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), which shows that while average fixed-rate mortgages (FRMs) move slightly higher this week, the average 30-year fixed-rate mortgage ends the year below four percent, averaging 3.87 percent with an average 0.6 point for the week ending Dec. 31, 2014. This total is up from last week, when it averaged 3.83 percent. A year ago at this time, the 30-year FRM averaged 4.53 percent. Also this week, the 15-year FRM averaged 3.15 percent with an average 0.6 point, up from last week when it averaged 3.10 percent. A year ago at this time, the 15-year FRM averaged 3.55 percent.

"While mortgage rates edged up this week, they remain near 2014 lows," said Frank Nothaft, vice president and chief economist of Freddie Mac. "Looking at full year data, the 30-year fixed-rate average for 2014 was 4.17 percent, the highest annual average since 2011. Also, the Conference Board reported that confidence among consumers rose in December and the S&P/Case-Shiller® Seasonally-Adjusted National house price index rose 4.6 percent over the 12-months ending in October 2014."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.01 percent this week with an average 0.5 point, unchanged from last week. A year ago, the five-year ARM averaged 3.05 percent. The one-year Treasury-indexed ARM averaged 2.40 percent this week with an average 0.4 point, up from last week when it averaged 2.39 percent. At this time last year, the one-year ARM averaged 2.56 percent.