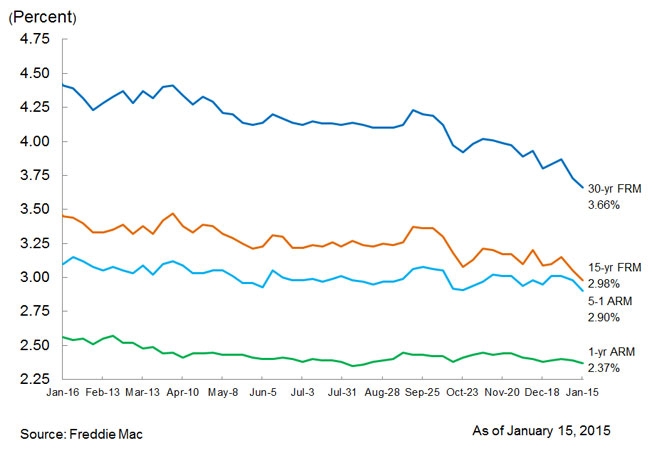

Fixed-Rates Slide for Third Consecutive Week

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing average fixed-rate mortgages (FRMs) falling for the third consecutive week as bond yields continued to drop despite a strong employment report. Averaging 3.66 percent for the week ending Jan. 15, down from last week when it averaged 3.73 percent. A year ago at this time, the 30-year FRM averaged 4.41 percent. The 30-year FRM is at its lowest level since the week ending May 23, 2013 when it averaged 3.59 percent. This also marks the first time the 15-year fixed rate mortgage has fallen below three percent since the week ending May 30, 2013. The 15-year FRM this week averaged 2.98 percent with an average 0.5 point, down from last week when it averaged 3.05 percent. A year ago at this time, the 15-year FRM averaged 3.45 percent.

"Mortgage rates fell for the third consecutive week as oil prices plummeted and long term treasury yields continued to drop despite a strong employment report," said Frank Nothaft, vice president and chief economist, Freddie Mac. "The economy exceeded expectations by adding 252,000 jobs in December which followed an upward revision of 50,000 jobs to the prior two months. The unemployment rate fell to 5.6 percent which was the lowest since June 2008."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.90 percent this week with an average 0.4 point, down from last week when it averaged 2.98 percent. A year ago, the five-year ARM averaged 3.10 percent. The one-year Treasury-indexed ARM averaged 2.37 percent this week with an average 0.4 point, down from last week when it averaged 2.39 percent. At this time last year, the one-year ARM averaged 2.56 percent.