Latest S&P/Case-Shiller Data Points to Potential Woes

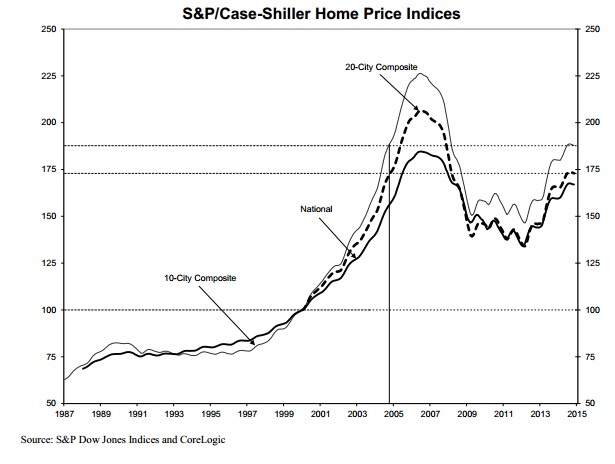

The latest data from the S&P/Case-Shiller Home Price Indices found housing prices slowing down during November 2014, leading to concern of a possibly weak housing market for this year.

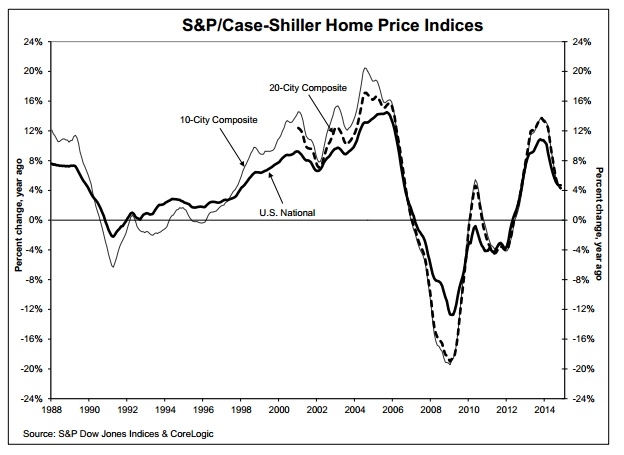

The 10-City Composite gained 4.2 percent year-over-year in November, but that was down from 4.4 percent in October. The 20-City Composite gained 4.3 percent year-over-year, which was down from 4.5 percent in October. The S&P/Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 4.7 percent annual gain in November 2014, slightly above the 4.6 percent level recorded one month earlier.

However, there was good news from November’s numbers: Miami and San Francisco posted annual gains of 8.6 percent and 8.9 percent, respectively, while Tampa, Atlanta, Charlotte, and Portland also saw year-over-year housing price increases.

David Blitzer, managing director and chairman of the Index Committee at S&P Dow Jones Indices, acknowledged that the housing market could be stronger.

“With the spring home buying season, and spring training, still a month or two away, the housing recovery is barely on first base,” Blitzer said. “Prospects for a home run in 2015 aren’t good. Strong price gains are limited to California, Florida, the Pacific Northwest, Denver, and Dallas. Most of the rest of the country is lagging the national index gains. Moreover, these price patterns have been in place since last spring. Existing home sales were lower in 2014 than 2013, confirming these trends.

“Difficulties facing the housing recovery include continued low inventory levels and stiff mortgage qualification standards,” Blitzer added. “Distressed sales and investor purchases for buy-to-rent declined somewhat in the fourth quarter. The best hope for housing is the rest of the economy where the news is better.”