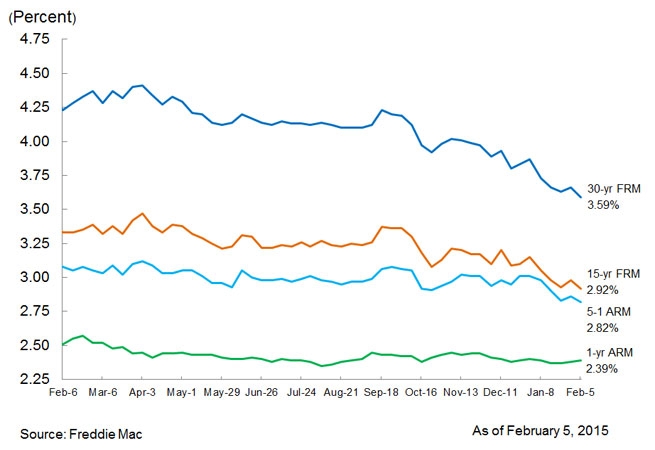

Fixed-Rates Return to Downward Trend

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing the 30-year fixed-rate mortgage (FRM) averaging 3.59 percent, with an average 0.7 point for the week ending Feb. 5, 2015, down from last week when it averaged 3.66 percent. A year ago at this time, the 30-year FRM averaged 4.32 percent. Also this week, the 15-year FRM averaged 2.92 percent with an average 0.6 point, down from last week when it averaged 2.98 percent. A year ago at this time, the 15-year FRM averaged 3.40 percent.

"Mortgage rates fell this week following the release of weaker than expected pending home sales, which fell 3.7 percent in December," said Len Kiefer, deputy chief economist of Freddie Mac. "Moreover, real GDP growth for the fourth quarter was 2.6 percent and the Institute for Supply Management reported slower growth in manufacturing last month, both missing market consensus forecasts."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.82 percent this week with an average 0.4 point, down from last week when it averaged 2.86 percent. A year ago, the five-year ARM averaged 3.12 percent. The one-year Treasury-indexed ARM averaged 2.39 percent this week with an average 0.4 point, up from last week when it averaged 2.38 percent. At this time last year, the one-year ARM averaged 2.55 percent.