Mortgage Credit Availability on the Rise in January

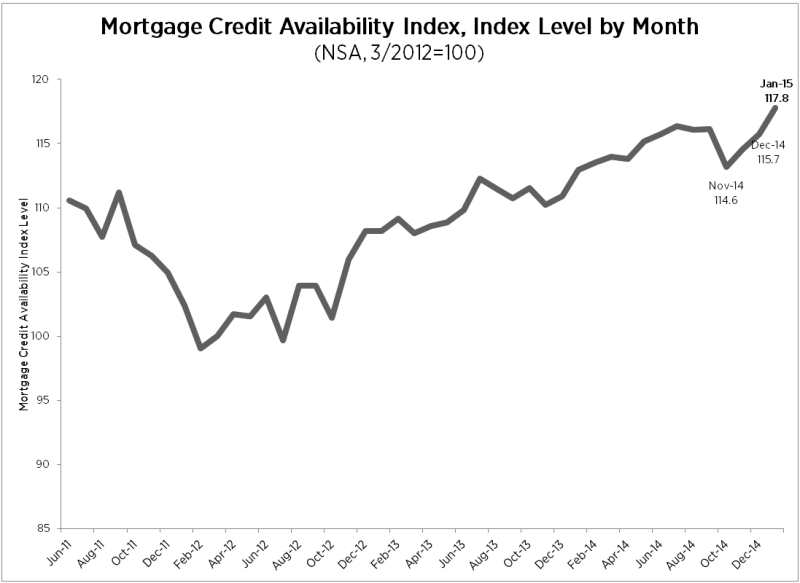

Mortgage credit availability increased in January according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) which analyzes data from the AllRegs Market Clarity product. The MCAI increased 1.8 percent to 117.8 in January. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of a loosening of credit. The Index was benchmarked to 100 in March 2012.

“Several new initiatives aimed at making mortgage credit more available and affordable to consumers were recently announced and resulted in a net loosening of credit over the month,” said Mike Fratantoni, MBA’s chief economist. “Fannie Mae and Freddie Mac announced new 97 percent LTV loan programs in December aimed at expanding access to conventional financing for new and well-qualified homebuyers. Additionally, FHA announced reductions in mortgage insurance premiums (MIP). Both of these announcements were designed to provide consumers with better access to mortgage credit."

“Since these announcements, roughly 40 percent of investors have begun to offer versions of the Fannie Mae 97 percent LTV program (Freddie Mac’s 97 percent LTV program will launch formally in March), and the conventional mortgage credit availability index increased three percent over the month as a result. Although the FHA MIP reductions went into effect Jan. 26, this initiative will be less likely to impact the MCAI, as it impacts pricing rather than availability of government credit.

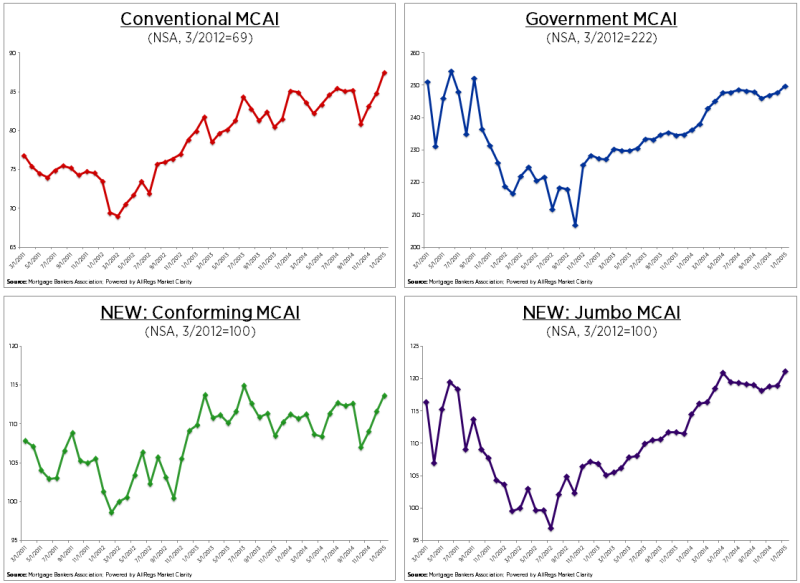

“Starting this month, MBA is now providing two additional credit availability indices: the Jumbo MCAI and Conforming MCAI. Growth in the jumbo loan market over the last few years has been a consistent and ongoing trend—with evidence of expansion on both the supply and demand sides of the market. These new component indices allow us to more precisely measure how credit availability is changing with regards to jumbo loan programs and their conforming (non-jumbo) counterparts.”

MBA now reports on five total measures of credit availability as part of the monthly MCAI release: The Total Mortgage Credit Availability Index, the Conventional Mortgage Credit Availability Index, the Government Mortgage Credit Availability Index, the Conforming Mortgage Credit Availability Index, and the Jumbo Mortgage Credit Availability Index, with historical data back to 2011.

All four Component Indices increased over the month with the largest gains observed in the Conventional MCAI (up 3.1 percent) and Jumbo MCAI (up 1.9 percent). The Conforming [Non-Jumbo] MCAI was up 1.8 percent, while the Government Index, which examines FHA, VA, and USDA loan programs, was up 0.9 percent.