Job Growth Spurs Rise in Fixed-Rates

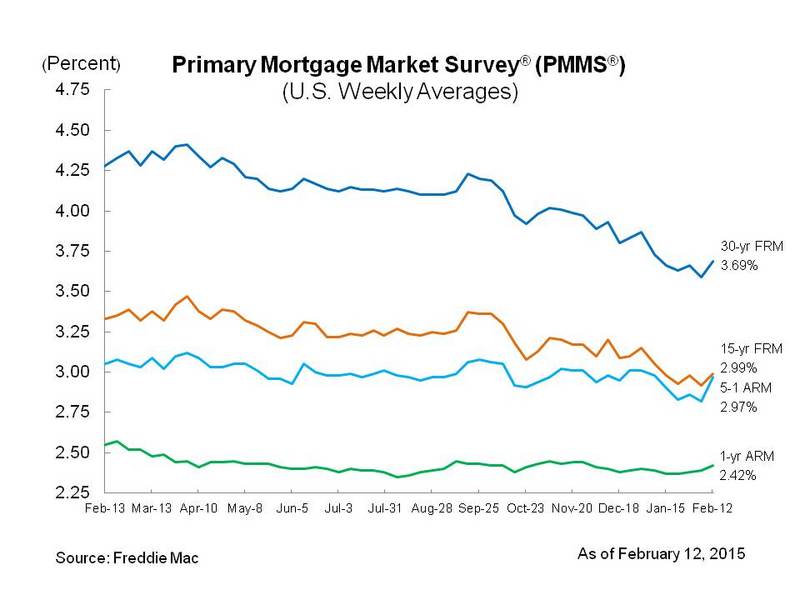

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing average fixed mortgage rates moving higher amid a strong employment report. Regardless, fixed-rate mortgages rates still remain near their May 23, 2013 lows. This week, the 30-year fixed-rate mortgage (FRM) averaged 3.69 percent with an average 0.6 point for the week ending Feb. 12, 2015, up from last week when it averaged 3.59 percent. A year ago at this time, the 30-year FRM averaged 4.28 percent. Also this week, the 15-year FRM this week averaged 2.99 percent with an average 0.6 point, up from last week when it averaged 2.92 percent. A year ago at this time, the 15-year FRM averaged 3.33 percent.

"Mortgage rates rose this week following strong economic data," said Len Kiefer, deputy chief economist, Freddie Mac. "The economy added 257,000 new jobs in January after robust increases of 329,000 in December and 423,000 in November. The unemployment rate edged up to 5.7 percent last month from 5.6 percent in December. Average hourly earnings rose 0.5 percent, following a 0.2 percent decline in December."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.97 percent this week with an average 0.5 point, up from last week when it averaged 2.82 percent. A year ago, the five-year ARM averaged 3.05 percent. The one-year Treasury-indexed ARM averaged 2.42 percent this week with an average 0.4 point, up from last week when it averaged 2.39 percent. At this time last year, the one-year ARM averaged 2.55 percent.