Chilly Scenes of Winter: Home Sales, Builder Confidence Drop

The first two months of 2015 seem to be a bit frosty, both in terms of weather across much of the country as well as in housing and home building data.

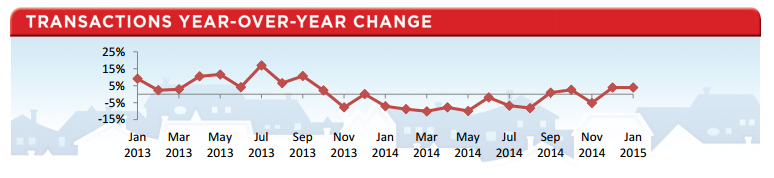

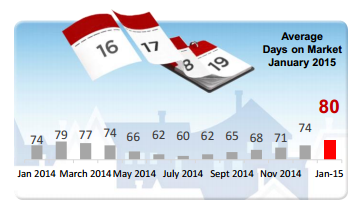

January’s home sales were 3.9 percent lower on a year-over-year basis, according to new data released by RE/MAX. For all homes sold in January, RE/MAX determined that the median sales price was $189,000–3.3 percent lower than the median price in December but 11.2 percent the January 2014 level. Last month marked the 36th consecutive month of median price increases.

RE/MAX identified price appreciation as the result of pressure from year-over-year inventory losses, with 48 out of 53 metro areas reporting higher sales prices than one year ago. Inventory supply has been down approximately 10 percent for the last three months.

RE/MAX identified price appreciation as the result of pressure from year-over-year inventory losses, with 48 out of 53 metro areas reporting higher sales prices than one year ago. Inventory supply has been down approximately 10 percent for the last three months.

Dave Liniger, CEO, chairman and co-founder of RE/MAX, insisted that these numbers should not be the cause of concern.

“One month certainly doesn’t make a trend,” Liniger said. “As we saw last year, home sales started rather slow, but rebounded during the prime selling months. In fact, 2014 ended with a respectable 4.9 million sales of existing homes, which we believe represents a sustainable rate of growth. So, we still need a few more months of data to tell how this market will perform in 2015.”

Separately, troublesome numbers were recorded in National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI), which found builder confidence in the market for newly built, single-family homes in February down two points to a level of 55. Two of the three HMI components posted losses in February: The component gauging current sales conditions edged one point lower to 61 while the component measuring buyer traffic fell five points to 39. The gauge charting sales expectations in the next six months held steady at 60. Confidence was down in three of the four geographical regions mapped out by the NAHB, with only the West showing an increase in builder confidence.

Nonetheless, the NAHB insisted that everything was copasetic.

"For the past eight months, confidence levels have held in the mid- to upper 50s range, which is consistent with a modest, ongoing recovery," said NAHB Chief Economist David Crowe. "Solid job growth, affordable home prices and historically low mortgage rates should help unleash growing pent-up demand and keep the housing market moving forward in the year ahead."