Nearly Two Million Loan Mod Solutions Offered to Homeowners in 2014

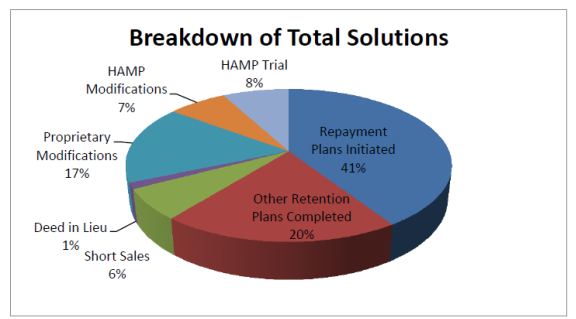

HOPE NOW has released its final 2014 loan modification data, which shows that more than 1.88 million homeowners received a mortgage solution. Mortgage solutions include loan modifications, short sales, deeds in lieu and other workout plans. The industry offered homeowners over 489,000 permanent loan modifications. Of the total number of loan modifications, approximately 352,000 were proprietary and 136,898 were completed under the Home Affordable Modification Program (HAMP). HAMP data is reported by the United States Department of Treasury.

Since 2007, the mortgage industry has completed more than 23 million non-foreclosure solutions for homeowners. This represents a combination of long term and short term tools. Mortgage servicers have completed over 7.3 million total permanent loan modifications in that same time period. Of those loan modifications, approximately 5.9 million were via proprietary programs and 1,448,456 were completed under HAMP.

Foreclosure starts and completed foreclosure sales both declined compared to data reported in 2013. There were approximately 842,000 foreclosure starts in 2014, compared to 1.28 million in 2013—a decline of approximately 34 percent. Completed foreclosure sales were approximately 455,000 in 2014, compared to 624,000 in 2013—a decline of 27 percent.

The inventory of loans that were seriously delinquent in December 2014 was lower than the total from the same point in 2013. This has been a trend for more than two years. In the last month of 2014, there were approximately 1.92 million loans in this category, compared to 2.03 million at the end of 2013. This represents a decline of almost five percent. Delinquency data is extrapolated from data received by the Mortgage Bankers Association for the fourth quarter of 2014.

Short sales for 2014 were approximately 130,000, bringing the life to date total to 1.57 million. Deeds in lieu for the year totaled 28,000, for a life to date total of 127,000. These non-foreclosure tools are used by servicers in the event that a home retention option is not a viable one. HOPE NOW has been tracking short sale and deed in lieu data since December 2009.

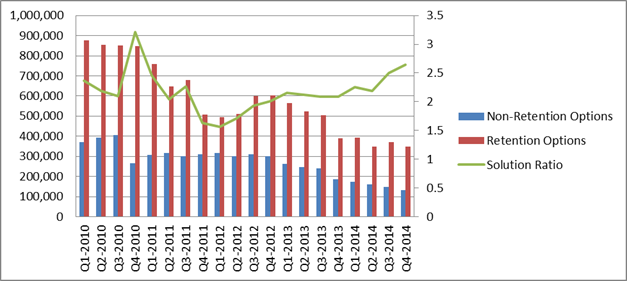

Year-end data showed a decline in the number of loan modifications completed, compared to 2013. However, there were significant declines in foreclosure starts and sales along with it. This has been a trend for several years as the number of delinquent homebuyers continues to decline year to year:

►Loan mods completed decreased from 767,000 in 2013 to 489,000 in 2014—a decline of approximately 36 percent.

►Foreclosure starts decreased from 1.28 million in 2013 to 842,000 in 2014—a decline of more than 34 percent.

►Foreclosure sales decreased from 624,000 in 2013 to 455,000 in 2014—a decline of 27 percent.

Loan modifications continued to decline from 3Q 2014 to 4Q 2014. However, loan modifications continued to outpace foreclosure sales:

►Loan mods completed decreased from 113,000 in Q3 2014 to 108,000 in Q4 2014—a slight decline of approximately four percent.

►Foreclosure starts decreased from 215,000 in Q3 2014 to 205,000 in Q4 2014—a decline of five percent.

►Foreclosure sales decreased from 110,000 in Q3 2014 to 96,000 in Q4 2014—a decline of 13 percent.

The total number of non-foreclosure solutions and loan modifications increased in December, compared to November. Foreclosure sales and starts both increased. Serious delinquencies continued to trend downward:

►Loan mods completed increased from 33,000 in November 2014 to 37,000 in December 2014—an increase of approximately 12 percent.

►Foreclosure sales increased from 28,000 in November 2014 to 29,000 in December 2014—an increase of four percent.

►Foreclosure starts increased from 60,000 in November 2014 to 80,000 in December 2014—an increase of 33 percent.

►Serious delinquencies of 60 days or more decreased from 1.96 million in November 2014 to 1.92 million in December 2014—a decline of two percent.