Nearly 60 Percent of HELOCs Scheduled to Reset With Higher Payments Are on Underwater Homes

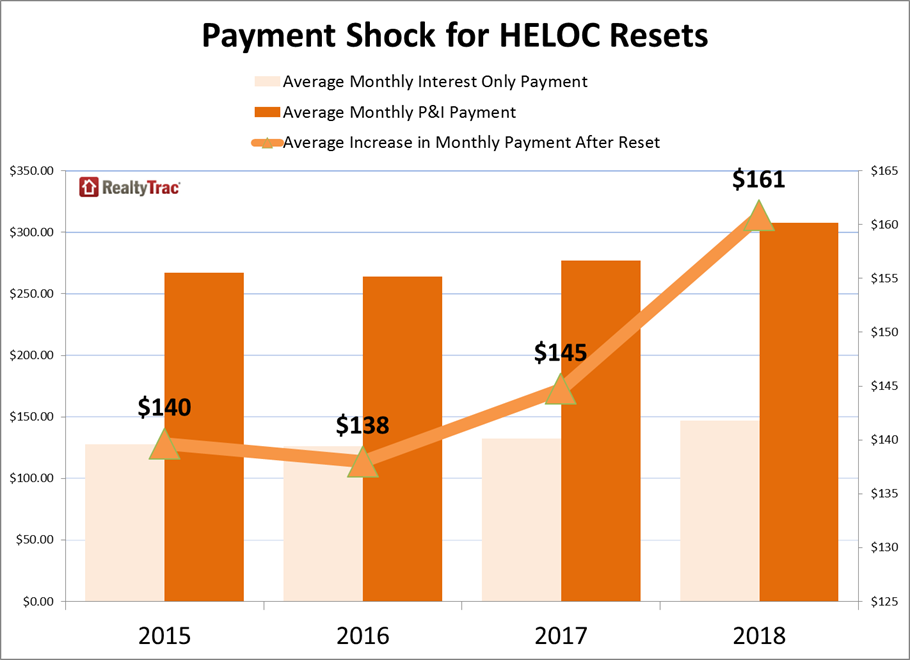

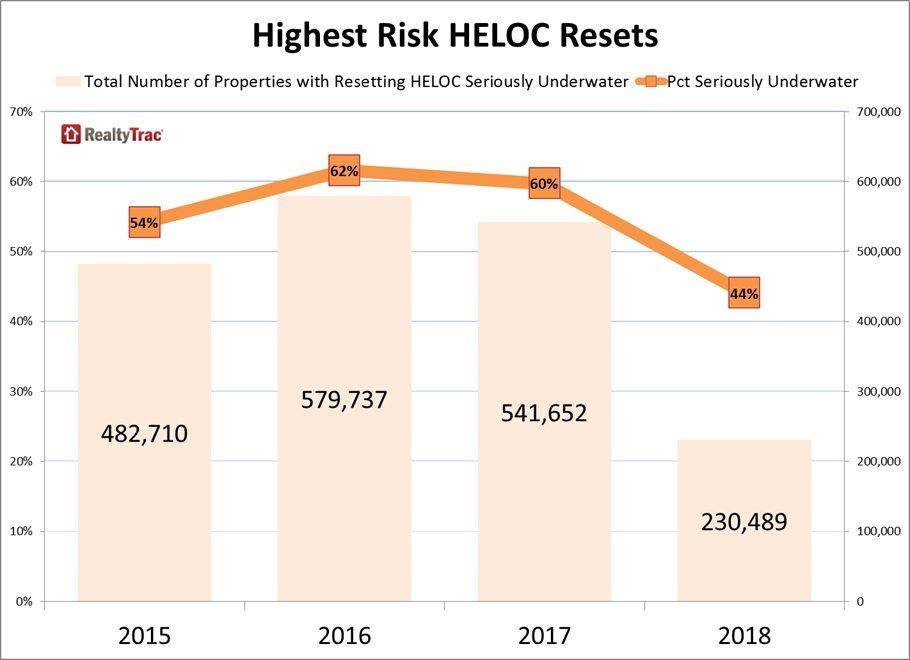

RealtyTrac has released its first-ever U.S. HELOC Resetting Report, which found that 56 percent of the 3.3 million Home Equity Lines of Credit potentially resetting with higher, fully amortizing monthly payments from 2015 to 2018 are on properties that are seriously underwater. For the report, RealtyTrac analyzed open HELOCs originated between 2005 and 2008 with the assumption that these loans will reset with fully amortizing monthly payments after a 10-year period of interest-only payments. RealtyTrac used average HELOC utilization rates from the New York Federal Reserve and the prime interest rate of 3.25 percent to calculate the outstanding balance of the loans and to calculate the interest-only and fully amortizing monthly payments. See full methodology below.

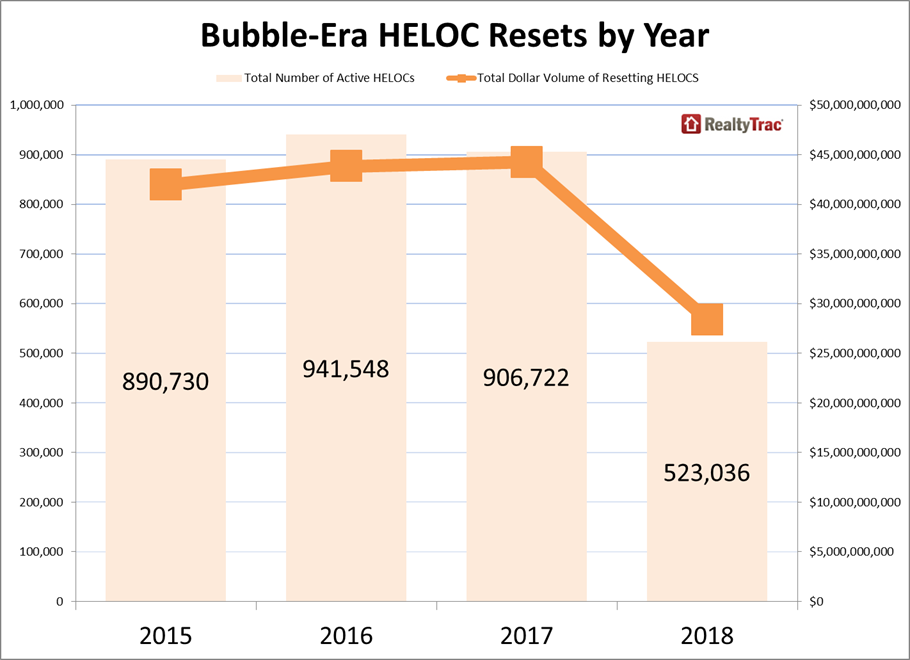

A total of 3,262,036 HELOCs with an estimated total balance of $158 billion that originated during the housing price bubble between 2005 and 2008 are still open and scheduled to reset between 2015 and 2018. Of these, 1,834,588 (56 percent) are on residential properties that are seriously underwater, meaning the combined loan to value ratio of all outstanding loans secured by the property is 125 percent or higher.

“Homes purchased or refinanced near the peak of the housing bubble between 2005 and 2008 are much more likely to still be underwater despite the strong recovery in home prices over the last three years,” said Daren Blomquist, vice president at RealtyTrac. “Furthermore, many homeowners with HELOCs who have positive equity likely already refinanced to mitigate the payment shock from a resetting HELOC—an option not readily available for homeowners still underwater."

“While these underwater homeowners experiencing payment shock from resetting HELOCs are at higher risk for default, the good news is that we’ve already seen a large wave of more than 700,000 resetting HELOCs in 2014 without a corresponding wave of defaults,” said Blomquist. “The bad news is that a much lower 40 percent of those 2014 HELOC resets were on seriously underwater homes. We are entering a period of higher risk over the next four years when it comes to resetting bubble-era HELOCs—especially given slowing home price appreciation that offers underwater homeowners less hope of recovering their equity in the short term.”

With 645,872 HELOCs scheduled to reset over the next four years, California led the way among the states in terms of sheer volume of resetting HELOCs. A total of 423,706 (66 percent) of those resetting HELOCs in California are on homes still seriously underwater, and the average monthly payment increase on HELOCs resetting in California over the next four years is $215.

“Many of our agents are consulting clients through HELOC payment transitions that are finally upon them,” said Mark Hughes, chief operating officer at First Team Real Estate, covering the Southern California market. “We are entering the first of a multi-year swing where we will encounter an elevated level of HELOCs with resetting loan payments on loans that were feasible during the boom. Many of these auto resets are moving from interest only to principle and interest payments and drastically increasing homeowner monthly liabilities, to the extent that they need to sell to get out from under the new payment. Many will be stuck where many of their neighbors found themselves seven years ago—with not many options. There will be fallout and distress on a smaller scale as the bursting bubble clean-up continues. Many homeowners who got through the downturn relying on the values don't support an easy exit.”

Florida had the second highest number among all states of resetting HELOCs over the next four years, with 513,229, followed by Illinois with 158,199. In both Florida and Illinois, seriously underwater homes backed 71 percent of the resetting HELOCs over the next four years.

Texas had the fourth highest number of resetting HELOCs with 158,017 over the next four years—36 percent of which were on seriously underwater homes, and New Jersey had the fifth highest number of resetting HELOCs with 145,312 over the next four years—47 percent of which were on seriously underwater homes. Other states among the top 10 for resetting HELOCs over the next four years were Ohio (136,327), New York (132,492), Arizona (122,749), Pennsylvania (110,493), and Washington (110,372).

Nevada had the highest percentage of HELOC resets over the next four years on homes that are still seriously underwater, 84 percent, followed by Arizona with 74 percent of HELOC resets on seriously underwater homes. In both Florida and Illinois 71 percent of the homes with resetting HELOCs in the next four years are still seriously underwater, the third and fourth highest share among the states. Other states among the top 10 for share of resetting HELOCs on seriously underwater homes were Utah (66 percent), California (66 percent), Maryland (65 percent), Washington (60 percent), New Mexico (58 percent), and Ohio (56 percent).