Foreclosures Nationwide Plummet Nearly 35 Percent Year-Over-Year in January

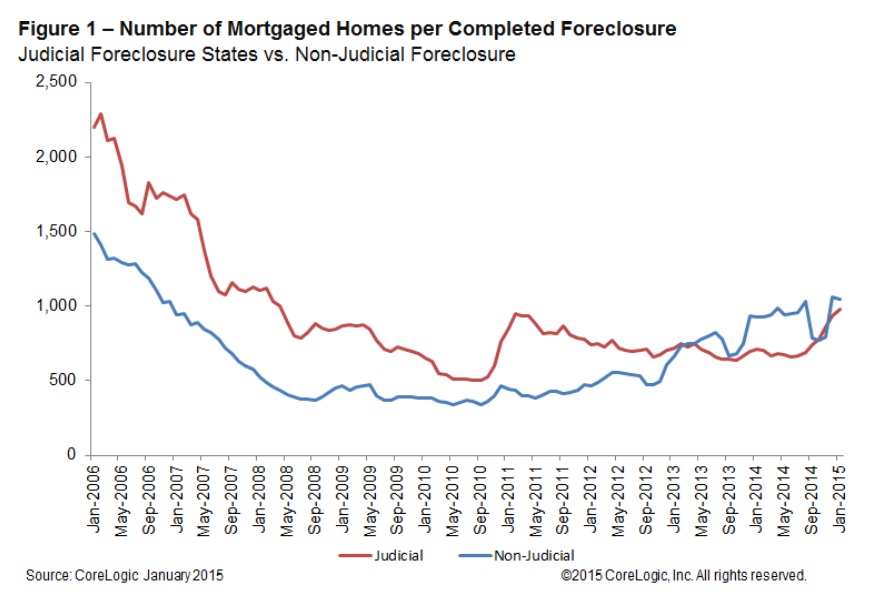

CoreLogic has released its January 2015 National Foreclosure Report which shows that the foreclosure inventory declined 33.2 percent and completed foreclosures declined 22.5 percent from January 2014. The report also shows there were 43,000 completed foreclosures nationwide in January 2015, down from 55,000 in January 2014 and representing a decrease of 63 percent from the peak of completed foreclosures in September 2010. Completed foreclosures have declined every month for the past 37 consecutive months. On a month-over-month basis, completed foreclosures were up 14.7 percent from the 37,000 reported in December 2014. As a basis of comparison, before the decline in the housing market in 2007, completed foreclosures averaged 21,000 per month nationwide between 2000 and 2006.

Completed foreclosures are an indication of the total number of homes actually lost to foreclosure. Since the financial crisis began in September 2008, there have been approximately 5.5 million completed foreclosures across the country, and since homeownership rates peaked in the second quarter of 2004, there have been approximately seven million homes lost to foreclosure.

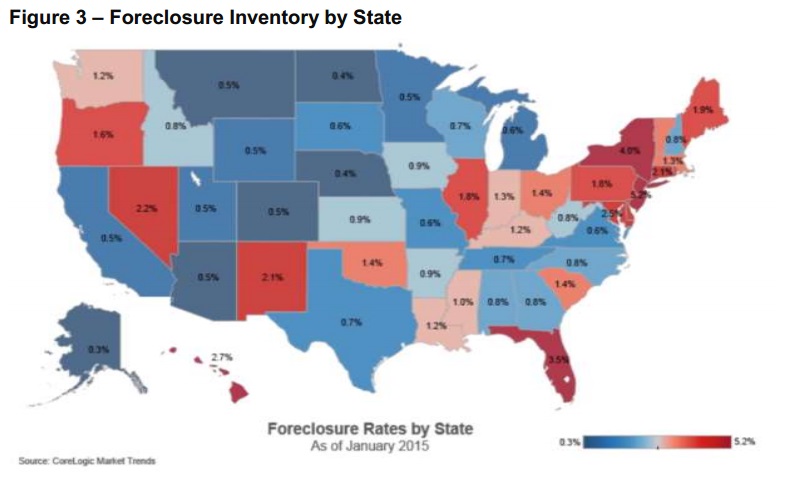

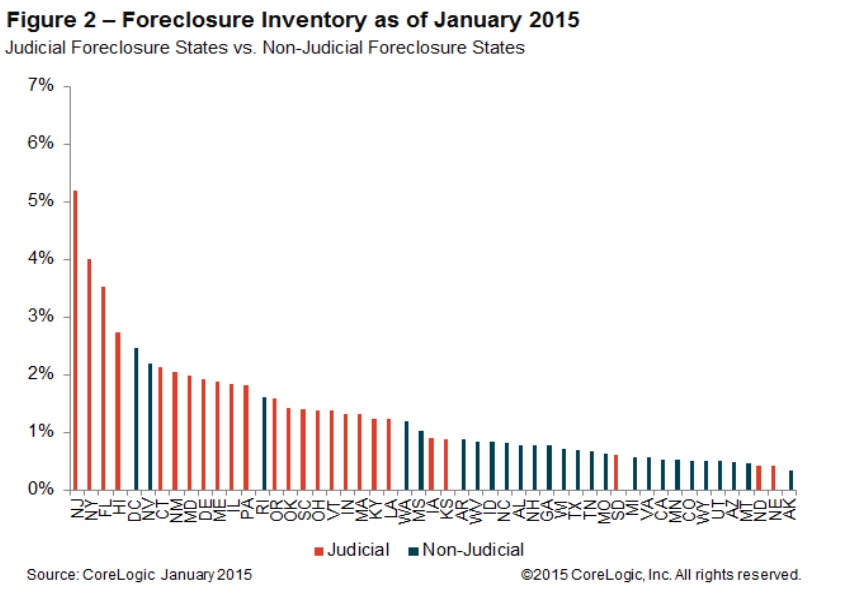

As of January 2015 the national foreclosure inventory was down 33.2 percent year over year, and approximately 549,000 homes were in some stage of foreclosure. This compares to 822,000 homes in January 2014 and represents 39 consecutive months of year-over-year declines. The foreclosure inventory as of January 2015 made up 1.4 percent of all homes with a mortgage, compared to two percent in January 2014. On a month-over-month basis, the foreclosure inventory was down 2.7 percent from December 2014. The current foreclosure rate of 1.4 percent is back to March 2008 levels.

“Job growth and home-value appreciation have worked to push the serious delinquency rate to the lowest since mid-2008 and foreclosures down by one-third from a year ago,” said Frank Nothaft, chief economist at CoreLogic. “With economic growth in 2015 expected to be better than last year, further declines in both delinquencies and foreclosures are projected for this year.”

“The foreclosure inventory continues to shrink with declines in all 50 states over the past 12 months,” said Anand Nallathambi, president and CEO of CoreLogic. “Florida, one of the hardest hit states during the foreclosure crisis, experienced a decline of almost 50 percent year over year which is outstanding news.”

Highlights as of January 2015:

►The number of mortgages in serious delinquency declined 23.8 percent from January 2014 to January 2015 with 1.5 million mortgages, or four percent, in serious delinquency (defined as 90 days or more past due, including those loans in foreclosure or REO). This was the lowest delinquency rate since June 2008.

►The foreclosure inventory has experienced 39 months of continuous declines and year-over-year double-digit declines for 28 consecutive months

The five states with the highest number of completed foreclosures for the 12 months ending in January 2015 were: Florida (111,000), Michigan (51,000), Texas (34,000), California (30,000) and Georgia (28,000). These five states accounted for almost half of all completed foreclosures nationally.

►Four states and the District of Columbia experienced the lowest number of completed foreclosures for the 12 months ending in January 2015: South Dakota (22), the District of Columbia (66), North Dakota (336), West Virginia (511) and Wyoming (532).

►Four states and the District of Columbia experienced the highest foreclosure inventory as a percentage of all mortgaged homes: New Jersey (5.2 percent), New York (four percent), Florida (3.5 percent), Hawaii (2.7 percent) and the District of Columbia (2.5 percent).

►The five states with the lowest foreclosure inventory as a percentage of all mortgaged homes were Alaska (0.3 percent), Nebraska (0.4 percent), North Dakota (0.4 percent), Arizona (0.5 percent) and Montana (0.5 percent).