Housing Starts Drop, Negative Equity Inches Up

The latest housing data offers a picture of one-step-forward, two-steps-back, with a slowdown where activity is needed and a problematic increase where bad news is not welcome.

According to today’s statistics released by the U.S. Census Bureau and the U.S. Department of Housing & Urban Development ZHUD), single-family housing starts in February were at a rate of 593,000, which is a 14.9 percent tumble from the revised January figure of 697,000. Privately-owned housing starts in February were at a seasonally adjusted annual rate of 897,000, a 17 percent fall from the revised January estimate of 1,081,000 and 3.3 percent below the February 2014 rate of 928,000.

Single-family authorizations in February were at a rate of 620,000, which is 6.2 percent below the revised January figure of 661,000. But in a bit of good news, privately-owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 1,092,000, which is three percent above the revised January rate of 1,060,000 and 7.7 percent above the February 2014 estimate of 1,014,000.

Single-family housing completions in February were at a rate of 595,000, 12.1 percent below the revised January rate of 677,000. Privately-owned housing completions in February were at a seasonally adjusted annual rate of 850,000, which is 13.8 percent below the revised January estimate of 986,000 and is 1.8 percent below the February 2014 rate of 866,000.

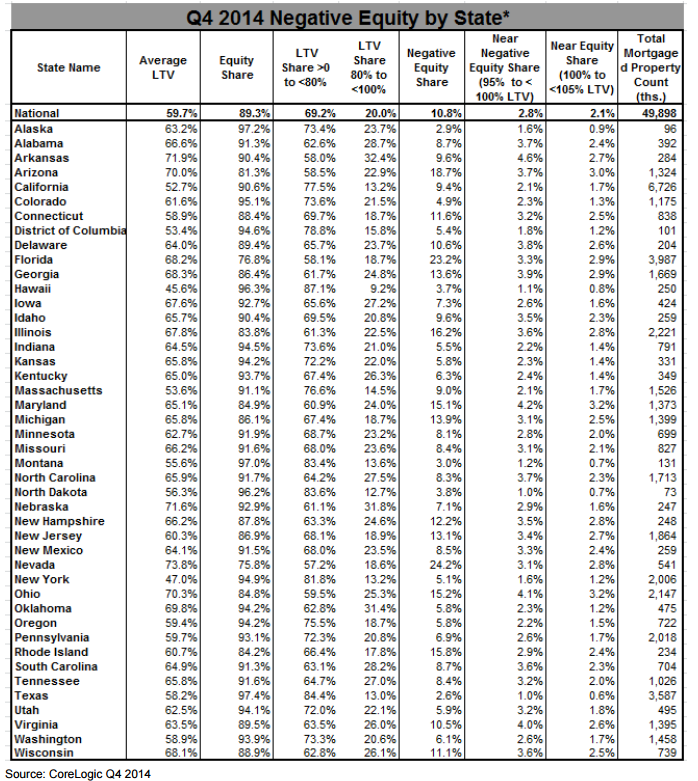

Separately, new data from CoreLogic determined that 1.2 million borrowers regained equity in 2014, bringing the total number of mortgaged residential properties with equity at the end of the fourth quarter of last year to approximately 44.5 million or 89 percent of all mortgaged properties. Borrower equity increased year over year by $656 billion in the fourth quarter.

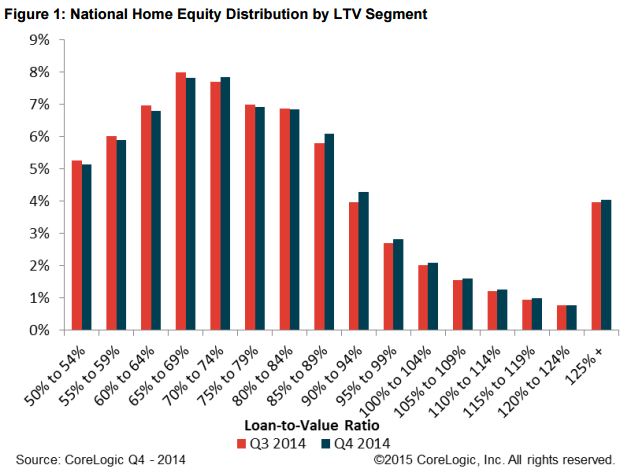

But now the bad news: CoreLogic also found that approximately 172,000 U.S. homes slipped into negative equity in the fourth quarter of 2014 from the third quarter 2014, increasing the total number of mortgaged residential properties with negative equity to 5.4 million, or 10.8 percent of all mortgaged properties. This is up from the third quarter of 2014, when 5.2 million homes, or 10.4 percent, were reported with negative equity. Still, these numbers are below the fourth quarter 2013 levels, when 6.6 million homes, or 13.4 percent, experienced negative equity woes.

“Negative equity continued to be a serious issue for the housing market and the U.S. economy at the end of 2014 with 5.4 million homeowners still underwater,” said Anand Nallathambi, president and CEO of CoreLogic. “We expect the situation to improve over the course of 2015. We project that the CoreLogic Home Price Index will rise five percent in 2015, which will lift about one million homeowners out of negative equity.”