Rent Hike of $6,700 Sets Off Social Media Buzz

The homeownership-versus-renting debate has taken a detour into social media, with a San Francisco renter who has become a viral sensation following the news of her $6,700 rent hike.

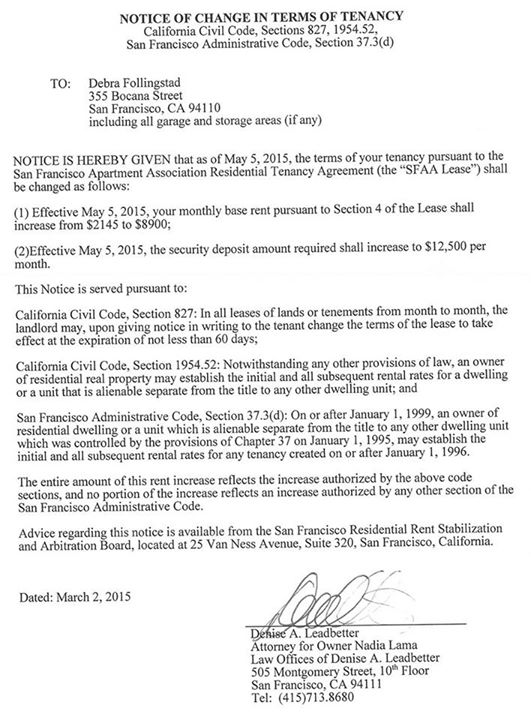

Deb Follingstad, a Chinese medicine practitioner who treats cancer patients, received a notice from her landlord on March 2 that her $2,145-per-month two-bedroom apartment would soon cost her $8,900 per month, with a new security deposit set at $12,500 per month. Follingstad, who has lived in her apartment, located above a former gas station/garage for 11 years, was under the impression that her apartment was rent-controlled.

But as Follingstad told Curbed San Francisco, the tenant who lived in the space below her apartment last year moved out, and the landlord pulled out the appliances and plumbing and converted it into a storage space, thus making the property a single-family space that was not covered under San Francisco’s Rent Ordinance of 1979. Follingstad’s situation is known by the legal term “constructive eviction,” where a massive rent increase forces a tenant out without having to through the judicial eviction process.

Follingstad posted a picture her rent increase notice on Facebook (see pic below), which set off a social media firestorm more than 7,100 shares of the picture and a host of scatological comments about her landlord, as one musical minded comment from a reader shared a link to the Dead Kennedys song “Let’s Lynch the Landlord.” Twitter also joined in the act, with “#DebFollingstad” trending among those upset about the deficit of affordable renting opportunities.

But online fame is not helping Follingstad’s housing woes, at least at the moment, and she is currently looking for an attorney, while seeking less expensive accommodations in San Francisco. Follingstad’s landlord, Nadia Lama, did not make any public comment on the story, although her lawyer, Denise A. Leadbetter, tried to blame Follingstad for spreading half-told stories.

“You are not receiving all the information from Deborah, and I have no other comment at this time,” said Leadbetter.