Mortgage Credit Availability, Home Prices on the Rise

The latest housing-related data finds upward movement in terms of the depth of available mortgage credit and the pricing potential of residential property.

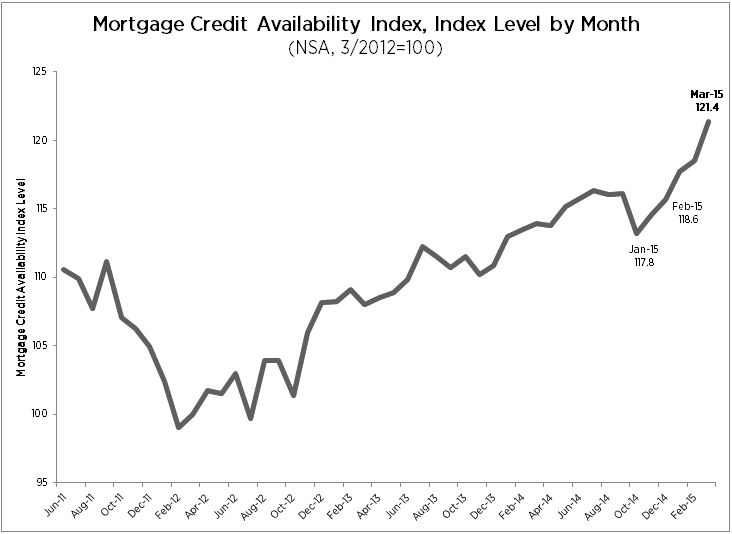

The latest numbers from the Mortgage Bankers Association’s (MBA) found the trade group’s Mortgage Credit Availability Index (MCAI) increasing 2.3 percent to 121.4 in March. The MCAI, which analyzes data from Ellie Mae’s AllRegs Market Clarity business information tool, reports on five total measures of credit availability: the Total Mortgage Credit Availability Index, the Conventional Mortgage Credit Availability Index, the Government Mortgage Credit Availability Index, the Conforming Mortgage Credit Availability Index and the Jumbo Mortgage Credit Availability Index. Of the four component indices, the Conforming MCAI saw the greatest easing (up three percent over the month) followed by the Conventional MCAI (up 2.4 percent), and the Government MCAI and Jumbo MCAI both increasing 1.8 percent.

Mike Fratantoni, MBA’s chief economist, credited the March data with a combination of positive activities.

“A number of factors contributed to a loosening of credit in March: Freddie Mac’s introduction of their 97 percent LTV program, additional loosening of parameters on jumbo loan programs, an increase in offerings of cash-out refinance loans, and continued expansion of the FHA streamline refinance and VA Interest Rate Reduction Refinance Loan (IRRRL) programs,” said Fratantoni. “As a result of these changes, all four component indexes of the MCAI increased last month: jumbo, conforming, conventional, and government. Although credit remains tight by historical standards, this increase in availability, coupled with low rates and job market strength, should lead to stronger home purchase activity this spring.”

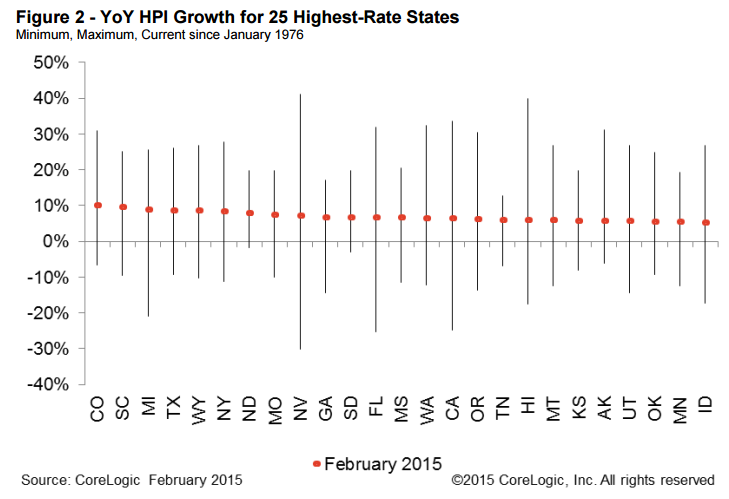

The increased level of credit comes at the right time, as the CoreLogic Home Price Index (HPI) from February found home prices nationwide, including distressed sales, increased by 5.6 percent year-over-year in February, which represents three years of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased by 1.1 percent in February compared to January. Excluding distressed sales, home prices increased by 5.8 percent on a year-over-year basis in February and increased by 1.5 percent on a month-over-month basis.

According to CoreLogic, 26 states and the District of Columbia were at or within 10 percent of their peak prices. Six states reached home price highs that broke records for the 39-year-old HPI: Colorado (up 9.8 percent), New York (8.2 percent), North Dakota (7.7 percent), Texas (8.5 percent), Wyoming (8.4 percent) and Oklahoma (5.2 percent),

“This is the hottest home price appreciation prior to the spring selling season in nine years,” said Anand Nallathambi, president and CEO of CoreLogic. “Assuming a benign interest rate environment and continued strong consumer confidence, we expect home prices to rise by an additional five percent over the next 12 months.”