Q1 Foreclosure Activity Drops to Eight-Year Quarterly Low

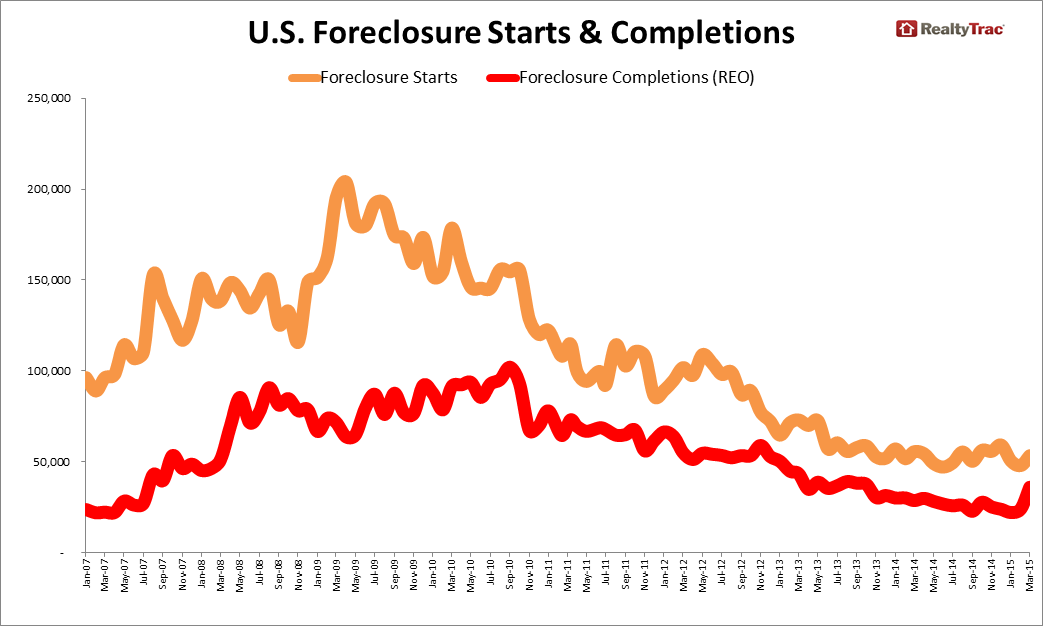

RealtyTrac has released its Q1 and March 2015 U.S. Foreclosure Market Report, which shows foreclosure filings—default notices, scheduled auctions and bank repossessions—were reported on 313,487 U.S. properties in the first quarter of 2015, down seven percent from the previous quarter and down eight percent from the first quarter of 2014 to the lowest quarterly total since the first quarter of 2007. There were a total of 122,060 U.S. properties with foreclosure filings in March, a 20 percent jump from a 104-month low February and up 4 percent from a year ago—the first month with a year-over-year increase in overall foreclosure activity since September 2010.

The increase in March was driven primarily by a jump in bank repossessions (REOs), which at 36,152 were up 49 percent from the previous month and up 25 percent from a year ago to a 17-month high—although still about one-third of the 102,134 REOs in September 2010, the peak month for REOs.

“The 17-month high in bank repossessions in March corresponds to a 17-month high in scheduled foreclosures auctions in October,” said Daren Blomquist, vice president at RealtyTrac. “The March increase is continued cleanup of distress still lingering from the previous housing crisis; not the beginning of a new crisis by any means. Some of most stubborn foreclosure cases are finally being flushed out of the foreclosure pipeline, and we would expect to see more noise in the numbers over the next few months as national foreclosure activity makes its way back to more stable patterns by the end of this year.”

Despite the spike in March, bank repossessions in the first quarter were still down from a year ago. Lenders repossessed 82,081 properties during the quarter, up seven percent from the previous quarter but still down 14 percent from a year ago.

A total of 152,147 U.S. properties started the foreclosure process for the first time in the first quarter of 2015, down 11 percent from the previous quarter and down eight percent from a year ago.

Other findings from the Q1 2015 report:

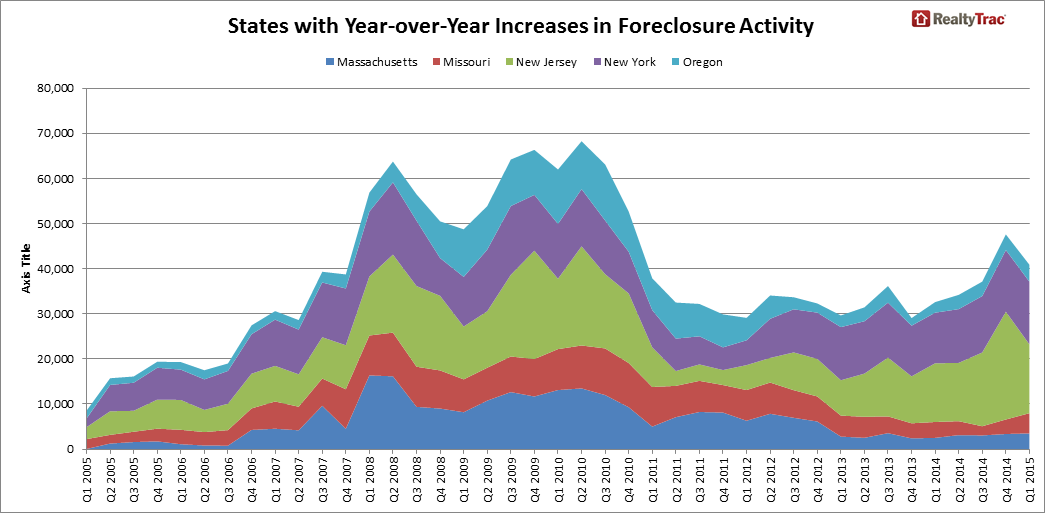

►States where first quarter foreclosure starts increased from a year ago, counter to the national trend, included Massachusetts (up 58 percent), Virginia (up 11 percent), Michigan (up 11 percent), and Illinois (up eight percent).

►States where first quarter bank repossessions (REO) increased from a year ago, counter to the national trend, included Ohio (up 54 percent), Maryland (up 39 percent), Missouri (up 34 percent), New Jersey (up 18 percent), and Illinois (up 16 percent).

►States with the highest foreclosure rates in the first quarter were Florida, Maryland, Nevada, Illinois and New Jersey.

►Among metropolitan statistical areas with a population of 200,000 or more, those with the highest foreclosure rates were Atlantic City, New Jersey, Rockford, Illinois, Ocala, Florida, Lakeland-Winter Haven, Florida, and Miami.

►A total of 53,514 properties started the foreclosure process in March, up 11 percent from the previous month but still down four percent from a year ago.

►A total of 50,760 properties were scheduled for foreclosure auction in March, up 11 percent from the previous month and up less than one percent from a year ago.

►Properties that completed the foreclosure process in the first quarter took an average of 620 days to complete the foreclosure process, up from 604 days on average in the previous quarter and up from 572 days in the first quarter of 2014.

►States with the longest average days to complete foreclosure for foreclosures completed in the first quarter were New York (1,475 days), New Jersey (1,115 days), Hawaii (1,058 days), Florida (975 days), and Kansas (963 days).