Spring Homebuyers in Full Swing as Fixed-Rates Dip Slightly

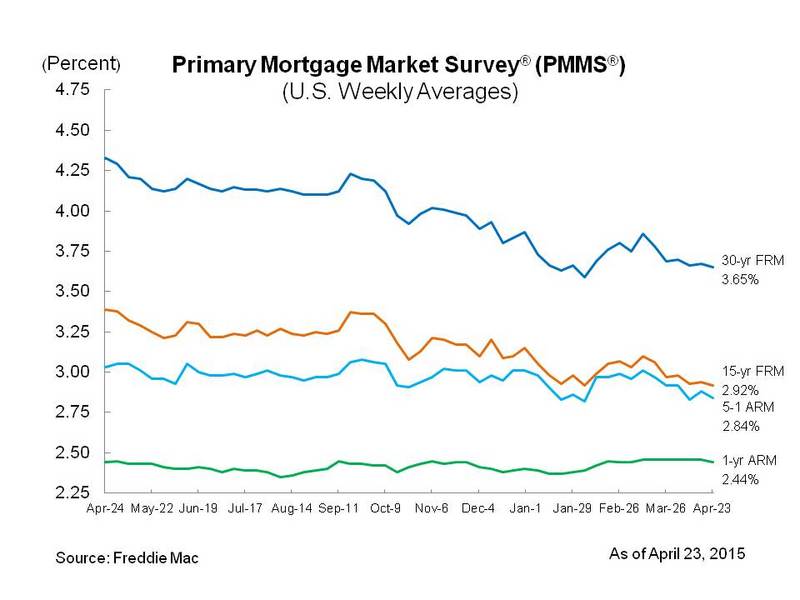

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing average fixed mortgage rates moving down slightly this week and remaining near their 2015 lows as the spring homebuying season continues.

For the week ending April 23, the 30-year fixed-rate mortgage (FRM) averaged 3.65 percent with an average 0.6 point for the week, down from last week when it averaged 3.67 percent. A year ago at this time, the 30-year FRM averaged 4.33 percent. The 15-year FRM this week averaged 2.92 percent with an average 0.6 point, down from last week when it averaged 2.94 percent. A year ago at this time, the 15-year FRM averaged 3.39 percent.

"Mortgage rates fell slightly to 3.65 percent this week, positive news for potential homebuyers in the market this spring," said Len Kiefer, deputy chief economist, Freddie Mac. "Purchase applications in 60 of the 100 markets that MiMi tracks are up from the same time last year, including 20 markets that are showing double-digit increases. Reinforcing this positive momentum,existing home sales surged 6.1 percent to a seasonally adjusted annual rate of 5.19 million units in March, the highest annual rate since September 2013. Housing inventory rose 5.3 percent to 2 million homes for sale, but unsold inventory was little changed at a 4.6 month supply."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.84 percent this week with an average 0.4 point, down from last week when it averaged 2.88 percent. A year ago, the five-year ARM averaged 3.03 percent. The one-year Treasury-indexed ARM averaged 2.44 percent this week with an average 0.4 point, down from last week when it averaged 2.46 percent. At this time last year, the one-year ARM averaged 2.44 percent.