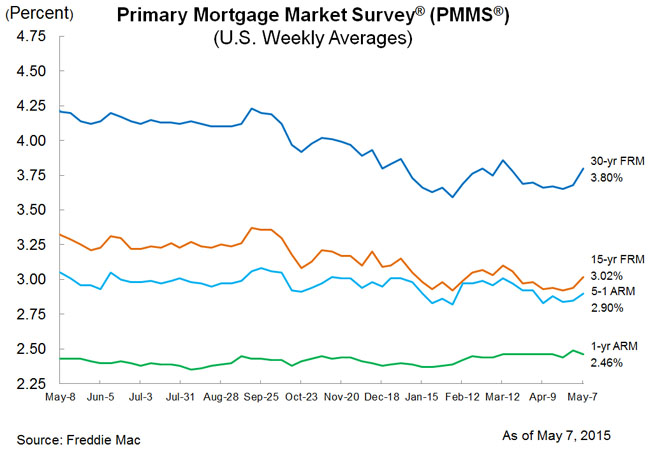

Mortgage Rates Hit Two-Month High

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing average fixed mortgage rates following 10-year Treasury yields higher. The 30-year fixed-rate mortgage (FRM) averaged 3.80 percent with an average 0.6 point for the week ending May 7, 2015, up from last week when it averaged 3.68 percent. A year ago at this time, the 30-year FRM averaged 4.21 percent. The 15-year FRM this week averaged 3.02 percent with an average 0.6 point, up from last week when it averaged 2.94 percent. A year ago at this time, the 15-year FRM averaged 3.32 percent.

"Mortgage rates rose this week to the highest level since the week of March 12 as a selloff in German bunds helped drive U.S. Treasury yields above 2.2 percent," said Len Kiefer, deputy chief economist, Freddie Mac. "The U.S. trade deficit reached $51.4 billion in March to the highest level since 2008. Also, the Institute for Supply Management's manufacturing index was unchanged in April, but manufacturing employment contracted as the index fell below 50 for the first time since May 2013."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.90 percent this week with an average 0.4 point, up from last week when it averaged 2.85 percent. A year ago, the five-year ARM averaged 3.05 percent. The one-year Treasury-indexed ARM averaged 2.46 percent this week with an average 0.4 point, down from last week when it averaged 2.49 percent. At this time last year, the one-year ARM averaged 2.43 percent.