California Coalition Calls Out OneWest Bank for High Number of Minority Foreclosures

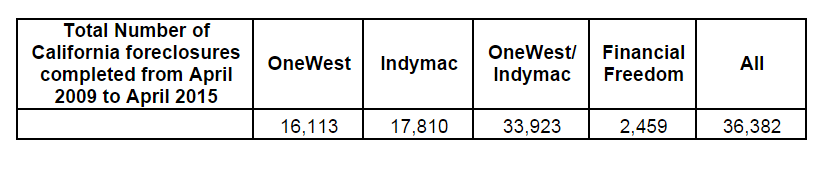

The California Reinvestment Coalition has called on federal regulators to investigate a high number of OneWest Bank foreclosures occurring in communities of color in California. The analysis was based on foreclosures processed since April 2009, when IndyMac Bank was purchased by billionaire investors and renamed OneWest Bank. When the 35,000-plus foreclosures OneWest and its subsidiary, Financial Freedom, has conducted in California since April 2009 were compared to U.S. Census data, the resulting maps show a high number of foreclosures in predominantly non-white communities. Sixty-eight percent of the foreclosures are in zip codes where the non-white population is 50 percent or greater. Thirty-five percent of the foreclosures are in zip codes were the non-white population is more than 75 percent of the total population.

“We’re calling for an investigation because this analysis raises serious red flags. We’re concerned about the extent of the harm imposed on California communities by OneWest foreclosures, and by the extent to which this harm is concentrated disproportionately in communities of color," said Kevin Stein, associate director of the California Reinvestment Coalition. "OneWest’s mortgage servicing has been widely criticized and these data increase our concerns that bad servicing practices may have had an outsized impact on communities of color. These are issues that need to be carefully investigated by the regulators, especially given OneWest’s proposed merger with CIT Group. Is foreclosure the main way in which OneWest relates to communities of color? And how many more OneWest foreclosures will we see, knowing that an estimated $1.4 billion in FDIC loss share payments may still be paid to the bank to cover the costs of future OneWest foreclosures?”